By Our Insights Desk

We started publishing The Ormax OTT Audience Report in 2021. The annual report is our endeavour to size the growing Indian OTT (digital video) market using primary research, than rely purely on secondary data, proxy variables (like Internet and smartphone penetration) or industry estimates.

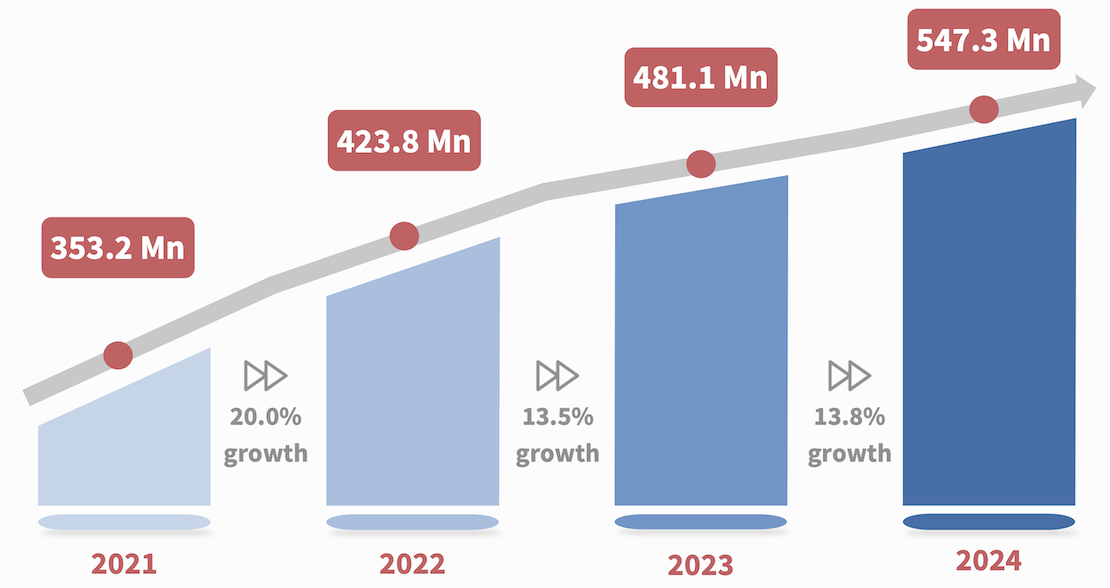

The fourth edition, titled The Ormax OTT Audience Report: 2024, based on data collected from 12,000 respondents across India in Jun-Jul 2024, is now out, and available for subscription (see details at the end of this article). As per the report, India's OTT audience universe, defined as those who have watched digital videos at least once in the last one month, is now at 547.3 Million (or 54.73 Crore) people. The growth from 2023 to 2024 stands at 13.8%, which is comparable to the growth from 2022 to 2023 (13.5%). India's OTT penetration now stands at 38% of the country's population, up from 34% last year. Year-on-year growth of India's OTT (digital video) universe can be seen in the chart below.

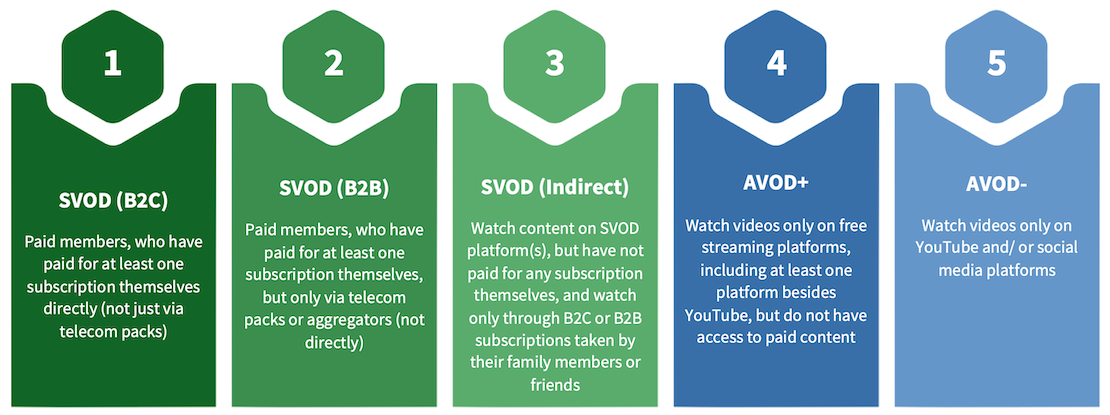

The report divides the 547.3 Million OTT universe into five segments, defined in the chart below, based on free vs. paid usage.

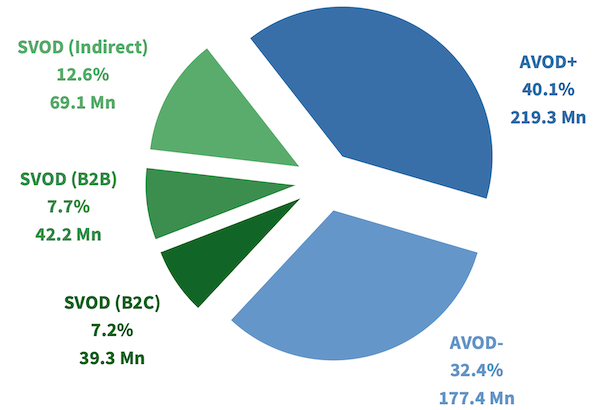

The size of the five segments can be seen in the chart below. SVOD (Subscription Video on Demand) audiences, who have access to paid content, comprise of 150.6 Million people, i.e., 27.5% of India's OTT universe. The remaining 72.5% (396.6 Mn) are accessing only free content, and a sizeable section out of these are watching videos only on YouTube and social media apps. The SVOD audience segment has witnessed a decline this year, and the growth of the OTT universe has been solely driven by the AVOD audience segment, which has grown by 21%.

The SVOD (B2C) segment averages at 2.5 subscriptions per user, leading to a total of 99.6 Million active direct-to-consumer paid subscriptions in India.

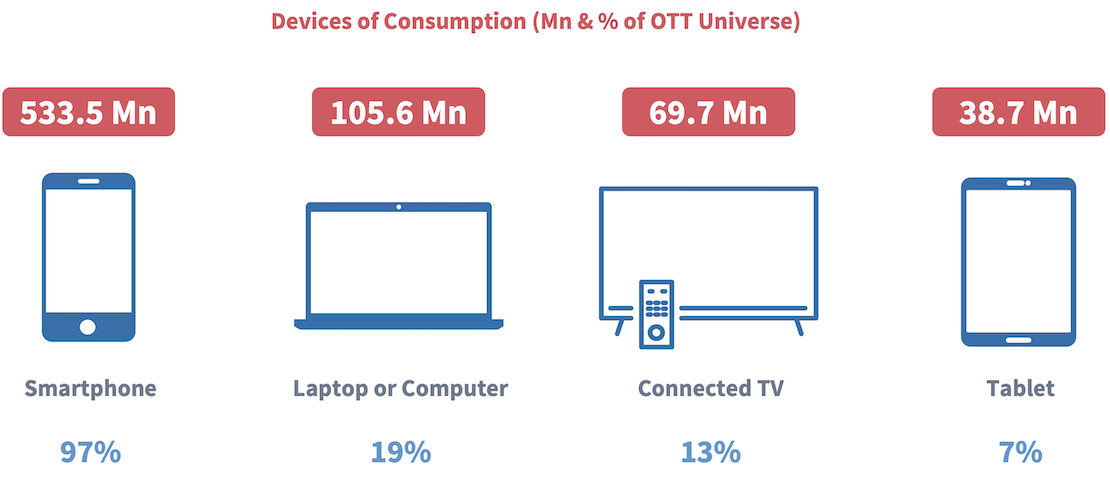

The report also provides an understanding into the various devices used by the OTT universe in India, to consume online videos, as seen in this chart:

The smartphone is the preferred device for online video consumption, with 97% of the OTT universe using it. In contrast, all other devices are used by less than 20% of the OTT audience. 81% Indian OTT audience use only the smartphone to watch online videos. Audience that use Connected TV to consume online videos stands at 69.7 Mn, constituting 13% of the OTT universe.

Read the press coverage of the report in Variety, Mint, and afaqs!.

To subscribe to The Ormax OTT Audience (Sizing) Report: 2024 please drop in an email to [email protected], and we will connect with you soon.

Top 50 streaming originals in India: The 2025 story

Our year-end report looks at the Top 50 most-watched originals on streaming platforms in India in 2025

Product launch: Ormax StreamView

Our new weekly tracker is designed to answer a simple, high-stakes question for the Indian media and advertising ecosystem: “What is India watching on OTT?”

Introducing Ormax Media Affluence (OMA)

OMA is a new audience classification system designed specifically to measure affluence level of audiences in context of the media & entertainment sector in India

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy