The pandemic has created a sense of uncertainty and unpredictability around the Indian box office. While there have been massive successes like K.G.F: Chapter 2, RRR, Pathaan, Ponniyin Selvan, and Kantara, significant underperformance of a whole host of high-profile films, that would have been expected to do very well in a pre-pandemic scenario, have left many stakeholders puzzled about the state of the Indian box office. Media stories on to the future of the theatrical medium have been, at times, extremely conservative, suggesting that the rise of the OTT medium spells doomsday for the multiplex business. But every time there’s a big blockbuster, the narrative changes, though only for a few weeks.

2022 grossed ₹10,637 Crore (₹106.37 Bn) at the Indian box office, making it the second-best year ever, only about ₹300 Crore (₹3 Bn) behind 2019 (see our year-end report). However, all-India footfalls in 2022 stood at 89.2 Crore (892 Mn), the lowest in more than a decade, excluding the pandemic years (2020 & 2021), when theatres were shut for most part. Pre-pandemic years registered footfalls in the 90 Cr (900 Mn) to 103 Cr (1030 Mn) range, and while 2022 did not match up to those numbers, it’s not a significantly lower number either. Growth in the Average Ticket Price, from ₹92 (in 2015) to ₹106 (in 2019) to ₹119 (in 2022) has contributed to the box office revenue growing, or at least not dropping, in most years on either side of the pandemic.

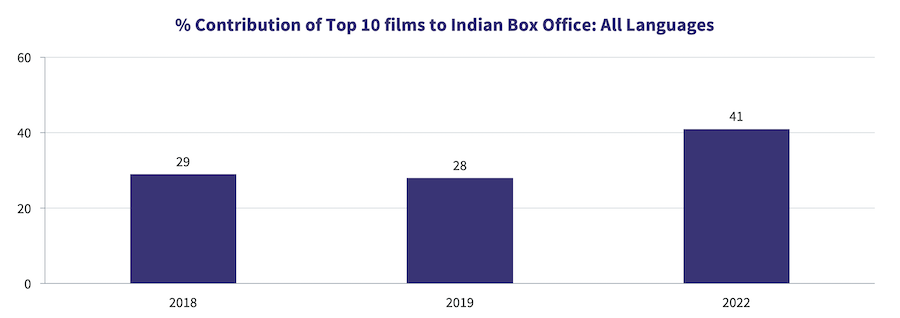

What, then, is the future of the theatrical medium? A closer look at the breakdown of box office revenue in recent years reveals a definitive trend. The chart below highlights the percentage contribution of the top 10 films to the domestic box office for two pre-pandemic years (2018 & 2019) and the first complete post-pandemic year (2022). Films that released in multiple languages (2.0, K.G.F: Chapter, 2, etc.) have been considered as a single film for the purpose of this analysis.

Top 10 films contributed 29% and 28% to the box office gross in 2018 and 2019 respectively. But in 2022, the share of top 10 films rose sharply to 41%. There are more than 1,500 theatrical releases in India, across languages, in a typical year. With just 10 of them accounting for a high 41% of the box office in 2022, it’s evident that the big films are getting even bigger, while smaller films are becoming even smaller, and struggling to find an audience in the theatres.

Franchise films, or those offer a big-screen worthy experience, have been ruling the Hollywood box office for more than a decade now. Such films have the ability to get the audiences to fill in theatre seats, an ever-so-challenging task in a world where there is a plethora of entertainment options, including that of watching films on streaming platforms.

The pandemic has accelerated the adoption of this trend to the Indian market. Post-pandemic, Indian audience have sharpened their criteria to decide which films to watch in a theatre, choosing big-screen spectacles (RRR, Avatar: The Way Of Water, Brahmastra, etc.), action extravaganzas (K.G.F: Chapter 2, Pathaan, etc.) and franchises (Drishyam 2, Bhool Bhulaiyaa 2), over more intimate, niche films. Even the presence of a superstar does not guarantee box office success today, and story-driven cinema, unless really unique and imaginative (e.g., Kantara), stands little chance to do well at the box office. Experience is more important than emotion on the big screen, in the streaming era today.

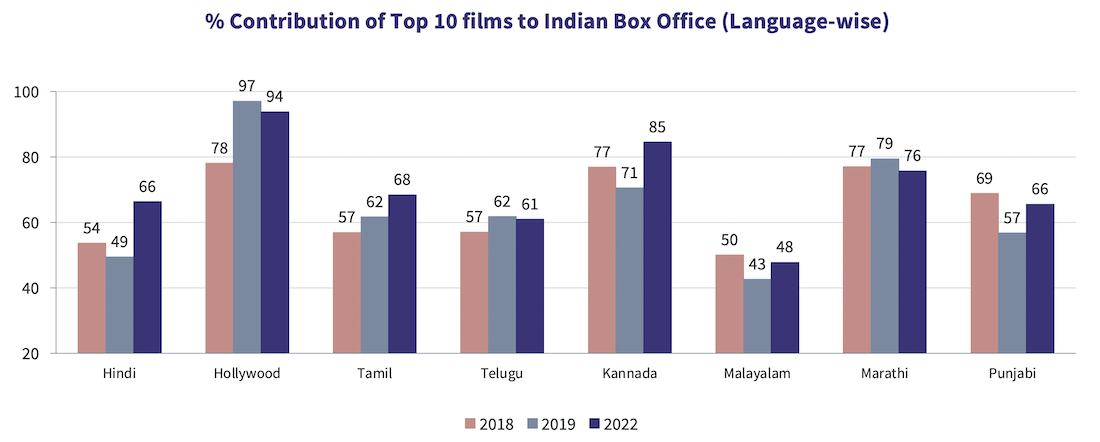

How does this trend play out for different language markets? The chart below captures the contribution of top 10 films to the Indian box office for the major languages.

Hollywood continues to get the highest box office share from the top 10 films, which contributed more than 90% of Hollywood box office in India in both 2019 and 2022. In Hindi, Tamil and Kannada markets, the contribution of top 10 films increased significantly in 2022, highlighting the increased polarization between big films and small films in these languages.

The other major languages have not shown an upward trend, but there is not a single major language where the contribution of top 10 films has gone down significantly since the pandemic. The presence of multiple marketable stars in Telugu ensures that each of their films grosses a certain minimum number at the box office, preventing the full extent of this polarization to play out in this market. Malayalam cinema stands out for its storytelling, with films (including the very recent ‘2018’) being watched for their unique and realistic storytelling (read more here, on how Malayalam cinema is different from rest of the South markets). For other languages like Marathi and Punjabi, the number of major releases is low, resulting in very high contribution from the top 10 films, even before the pandemic.

Language variations apart, the trend of the top films accounting for a growing share of the box office is here to stay. As a result, the business will be cyclic in nature, with a big blockbuster, followed by long periods of lull, and then another big blockbuster. This has been the case so far in 2023 for the Hindi language, where Pathaan gave the year a solid start, but almost all films (with the exception of The Kerala Story, and to a lesser extent, Tu Jhoothi Main Makkaar) have struggled at the box office since then.

The pandemic has not killed movie-going behaviour, but it has definitely changed its nature significantly. Big-ticket franchise or spectacle films have often been labeled ‘event films’. The term suggested that watching these films is an ‘event’ in the life of the audience. Implicit in that suggestion was the idea that the audience also watches other films, but don’t see them as ‘events’ as such. With this growing polarization between big and small films, the ‘non-event films’ category will continue to lose significance. The long-tail of releases will contribute lesser with each passing year, even as the big blockbusters will be in the running to set new box office records.

Ormax Cinematix's FBO: Accuracy update (February 2026)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major February 2026 releases vis-à-vis their actual box-office openings

OWomaniya! 2025: Quantifying gender diversity in Indian entertainment

The fifth edition of the OWomaniya! report by Ormax Media & Film Companion Studios, presented by Prime Video, reveals glaring statistics on gender disparity in the Indian entertainment industry

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy