By Our Insights Desk

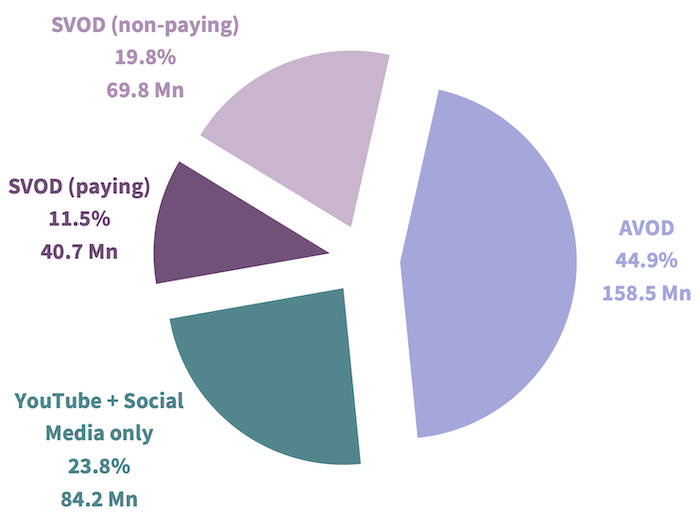

The Ormax OTT Audience Report: 2021 sizes India’s OTT universe (defined as people who have watched online videos at least once in the last one month) at 353.2 Million, which translates to 25.3% of India’s estimated 2021 population. The report also segments these users based on the nature of their usage, i.e., free vs. paid consumption, into one of the following four mutually-exclusive segments:

1. SVOD (paying): Current paid member of at least one streaming service; have paid for the subscription themselves

2. SVOD (non-paying): Watch content on SVOD platform(s), but have not paid for any subscription themselves

3. AVOD: Watch videos only on free streaming platforms, including at least one platform besides YouTube

4. YouTube + Social Media only: Watch videos only on YouTube and/ or social media platforms

The chart below shows the breakup of the 353.2 Million OTT universe by these four segments:

The distinction between the two SVOD segments, paying and non-paying, is an important aspect covered in the report. Across our interactions with streaming platforms, there are only two segments that come up in conversation: SVOD & AVOD. It is implicitly assumed that all ‘SVOD’ viewers pay for at least one SVOD service. However, the SVOD (non-paying) segment is 71% bigger in size than the SVOD (paying) segment, making it an important segment to account for in any growth strategy. This segment comprises of family members watching on common subscriptions, kids watching on subscriptions taken by their parents, friends sharing passwords, audience watching only through telecom bundles with no stand-alone subscriptions taken, etc.

For brand and content marketing, depending on campaign objectives, SVOD (paying) + SVOD (non-paying) may need to be considered as the more relevant definition of SVOD. In effect, this means that India’s SVOD universe is much larger than what is popularly believed. From a monetization perspective, it may be only 40.7 Million people. But from a consumption perspective, it’s a lot bigger at 110.5 Million. Looking at only SVOD (paying) as a target group can skew a platform’s perception of its core target group, because SVOD (non-paying) segment is more gender, age and market-inclusive than the SVOD (paying) segment.

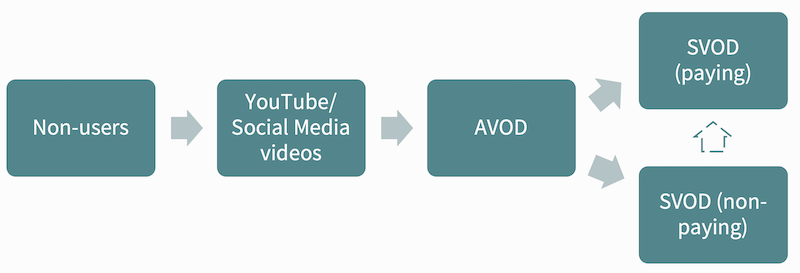

At 353.2 Million (or 25.3% population penetration), there is sizeable room for growth in India’s OTT universe, especially outside the top cities. Conventional wisdom suggests that a paid user goes through the following stages in their video consumption journey.

However, for a sizeable section of audience, the movement from AVOD to SVOD (non-paying) may not just be a detour but the last mile in the journey itself. They may never become SVOD (paying), for reasons that are primarily socio-economic in nature.

Can streaming platforms ignore these non-paying users? Certainly not, because they are viewers and hence influencers too. Should streaming platforms put in efforts to convert them into paying SVOD users? That’s a somewhat tricky question, because its answer depends on how a platform perceives the fundamental nature of the streaming medium in India to be: a family medium or a solo-consumption medium. If you are targeting a family, you should not see the non-paying segment as an opportunity lost. But if you are targeting individuals, which is how large part of streaming consumption in a mobile-centric market Iike India has been thus far, you would want them all.

Now that the paid content consumer base has crossed the 100 Million mark in India, these questions become key strategy and marketing questions for leading streaming platforms in India to address. Watch this space for more insights on how the market evolves over time on this front.

To subscribe to The Ormax OTT Audience Report: 2021, please drop in an email to [email protected], and we will connect with you soon.

Introducing Ormax Media Affluence (OMA)

OMA is a new audience classification system designed specifically to measure affluence level of audiences in context of the media & entertainment sector in India

From CTV to Micro Dramas: India's fascinating OTT spectrum

The simultaneous rise of Connected TV and Micro Drama audiences in India over the last year highlights how the Indian OTT market is expanding at both the premium and the mass ends simultaneously

Product update: Content testing for the horror genre

Based on our accumulated audience insights, we are introducing genre-specific drivers for horror films and series in our content testing tools, Ormax Moviescope and Ormax Stream Test

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy