Today (Sep 20, 2024) is National Cinema Day. The first instance of Cinema Day being announced by Multiplex Association of India (MAI) dates back only to September 2022. Since then, there have been a few instances when this ‘occasion’ has been celebrated, the last of which was on May 31, 2024, where it was branded ‘Cinema Lovers Day’. All these occasions have one thing in common: A ticket price of ₹99 in the leading multiplex chains of India, in most markets, excluding some in the South at times. The idea is simple: To stimulate additional demand through a price incentive.

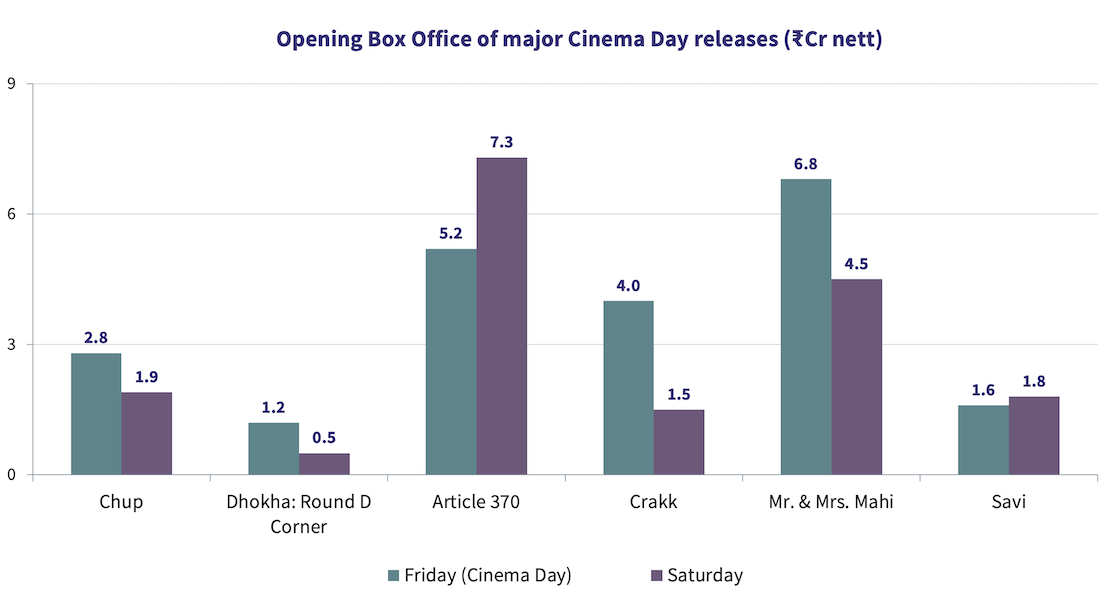

Since Sep 2022, six major Hindi films have benefited from Cinema Day being celebrated on the day of their release. Today, one more (Yudhra) will join the list. The table below showcases the first-day collections (nett box office in ₹Cr) of these films, and also, their collections on the following day (Saturday), when Cinema Day was not in observance.

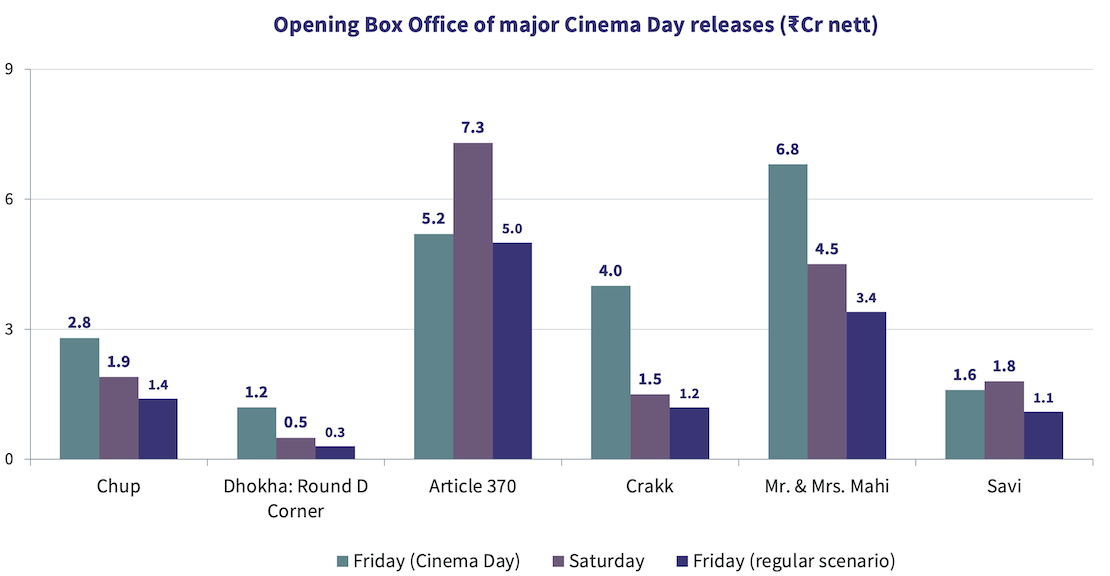

As an overall average based on all Hindi releases since Jan 2022, films with an opening of less than ₹5 Cr on a regular Friday (non-holiday, non-Cinema Day) grow by 26% from Friday to Saturday. This percentage is higher for smaller films, increasing to 39% for films opening at less than ₹2 Cr. Using this data on the Saturday box office, we can estimate what the Friday opening would have been, had the film released on a regular Friday. This calculation is somewhat simplistic, given that the Saturday business itself would be lower than a regular Saturday, because some of that demand was fulfilled on Friday, because of Cinema Day. Yet, the blue numbers in the chart below give us a fair sense of the hypothetical non-Cinema Day opening of the films.

As can be seen in all cases except Article 370 (which benefited from a growing audience pull from Friday to Saturday), the first-day box office goes up 2-4 times because of Cinema Day. A case in point is the May 2024 release, Mr. & Mrs. Mahi. The film was tracking at ₹3-3.5 Cr on our campaign tracking and first-day box office forecasting tool Ormax Cinematix through the course of its campaign. However, closer to the release, Cinema Lovers Day was announced, and the film opened at the number seen above, a growth of 100% on the initial tracking.

As per our annual box office report (read here), the average ticket price (ATP) for Hindi films in 2023 was ₹196. If one removes the impact of big-ticket blockbusters and holiday releases, it would come to about ₹175 for a film of the scale such as the examples above. In effect, it means that footfalls were boosted by 3-4 times because of the Cinema Day incentive. That’s a crazy multiplier. Is the film-going audience so price sensitive? Not really.

In February 2023, we published this analysis on how the Appeal (an Ormax Cinematix parameter) varies by ticket price. While the analysis showed that lower ticket prices stimulate Appeal, the multipliers are incremental at best, nowhere close to the 300-400% growth in footfalls observed on Cinema Day. Why are Cinema Days so effective then?

The answer lies in Cinema Day’s ability to event-ize a non-event film. In the current scenario, when streaming offers a plethora of options, non-event films have struggled to open at the box office, and the share of the big-ticket event blockbusters continues to go up (see this analysis). However, Cinema Day creates a mini-event of its own, where the pitch is the ticket price (₹99), and not the title (and its credentials) itself. All titles running, including holdover releases, become a part of this collective event. For example, Stree 2 will get a healthy boost at the box office today, on its sixth Friday. It’s almost like the theatrical audience are displaying holiday behaviour on a regular Friday.

Attractive as the idea is, it runs the risk of losing its event value if repeated too frequently. So far, the multiplex association has been pragmatic, restricting the observance to 2-3 times a year. One hopes that the studios don’t push for a higher frequency, as the idea would then lose its edge, like the BOGO (Buy One Get One) offers executed by specific films on certain days have.

The larger question, however, remains: Can observing Cinema Day 2-3 times a year fundamentally create a movie-going habit, bringing more audience into the fold of regular movie goers? In our annual report Sizing The Cinema 2024 (details here), it is reported that of the 92 Million film audience who watched at least one Hindi film in a theatre in 2023, only 32% (29 Million) watched three or more films. In other words, only 32% Hindi film audience pass the filter of being ‘regular’ audiences. In Tamil and Telugu industries, almost the entire audience base (76% and 83% respectively) are regulars. These industries have operated at ATP levels of ₹80-95 for the last few years, and that has contributed significantly, among other factors, towards maintaining the cinema-viewing culture in these states. If ₹99 was a definition of Cinema Day there, 70-80% theatres in the South markets would be celebrating Cinema Day everyday!

In conclusion, Cinema Days can provide spikes through event-ization, but they are not habit-forming as an idea, and hence, hold limited strategic value. This limits their potential towards the growth of the Hindi box office, both in the short and the long run.

Ormax Cinematix's FBO: Accuracy update (November 2025)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major November 2025 releases vis-à-vis their actual box-office openings

Product update: Content testing for the horror genre

Based on our accumulated audience insights, we are introducing genre-specific drivers for horror films and series in our content testing tools, Ormax Moviescope and Ormax Stream Test

The India Box Office Report: October 2025

Driven by Kantara - A Legend: Chapter-1, October 2025 has emerged as the highest-grossing box office month of the year at the India box office, with gross collections of ₹1,669 Cr

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy