Over its short existence in India, the streaming category (commonly referred to as "OTT") has aspired to be everything linear television could not, or did not want to, be. In the West, streaming and linear television are primarily differentiated by technology and mode of distribution, but principally cater to similar audience tastes. Which is why "TV series" is used interchangeably for linear television shows and streaming series. Unlike that, the Indian market has seen the evolution of streaming as a different content proposition altogether, on attributes like genre, story treatment, show length (number of episodes), and so on. Of course there's the emerging "TV+" idea that hopes to sit somewhere in between. But leaving that out for the moment, streaming content in India is arguably closer to theatrical content than to linear television content. Which also explains the significant overlap in India's SVOD (pay) audience profile and theatre-going population, to the extent of 80%+.

One of the differences between streaming and linear television is in the viewing behaviour of the two. Television is dominantly watched collectively, forming a family ritual. The need to 'bond' with the family is, in fact, the primary calling card of linear television in India, as explained in this 2021 article on this website. In contrast, steaming content, especially that behind paywall (web-series and direct-to-OTT films) is often watched alone. Reasons for this vary, ranging from lack of family-inclusive content to the extensive use of smartphone, a personal device, to stream such content.

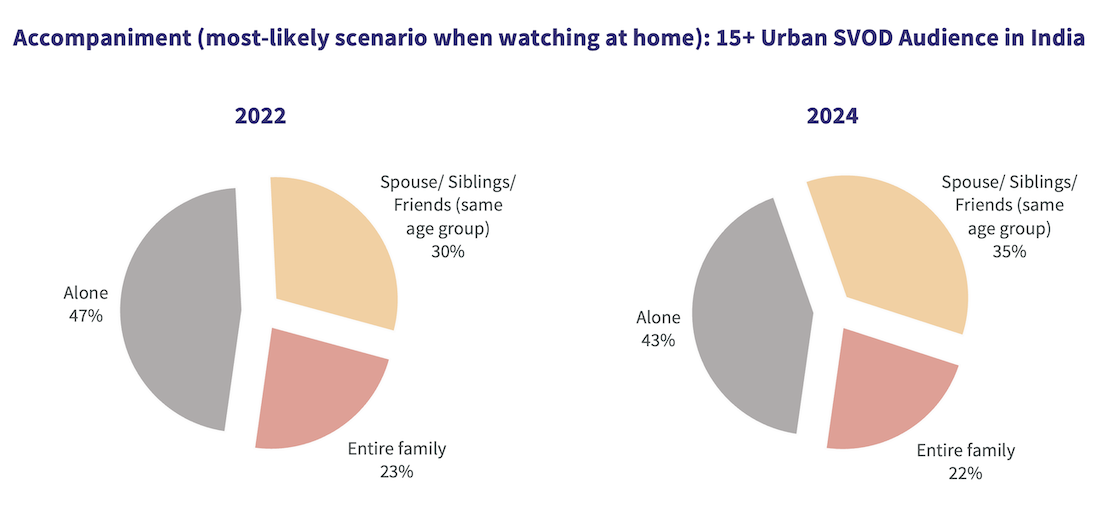

The findings of The Ormax SVOD Audience Report: 2024, an extensive research on viewing behaviour, content tastes & preferences, and media habits of urban adult (15+ yrs.) SVOD audiences in India, reveals an important emerging trend. In the research, audiences were asked to pick the most-likely accompaniment scenario when watching streaming content at their homes. The graphic below compares the findings of this parameter for 2022 vs. 2024.

There's a small but significant shift that can be seen from solo or individualistic viewing, to collective viewing. Four percentage points may not seem like a trend, but the swing of 8 percentage points (47 vs. 53 to 43 vs. 57) within just two years, is hard to ignore. If at all, one may have expected the solo consumption number to go up marginally in 2024, as 2022 would have some residual impact of the pandemic, which encouraged co-viewing.

It's important to note that the type of streaming content being dished out has not changed fundamentally over these two years. This change is behavioral and social in nature, and hints at early signs of growth in inclusivity in the pay streaming market in India.

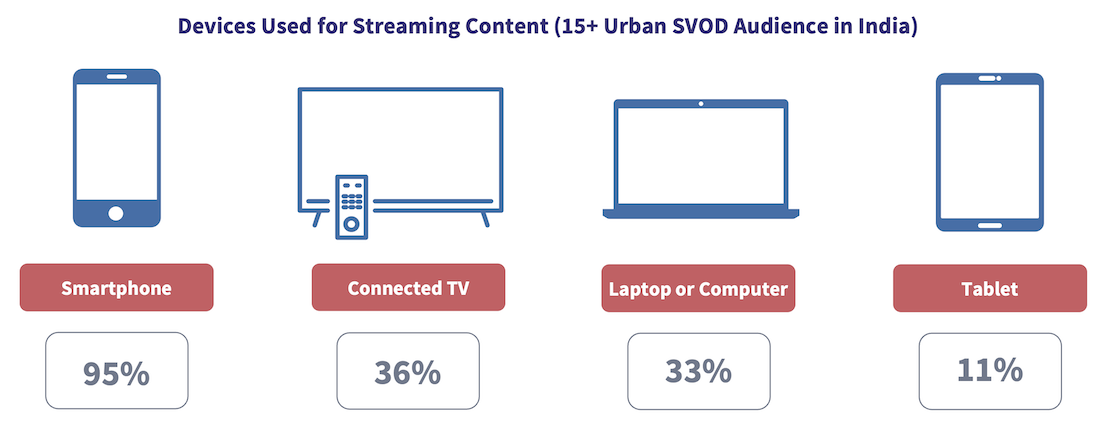

The shift becomes easier to understand if one looks at the devices on which SVOD audiences are watching streaming content in India. The chart below estimates the % SVOD audiences in India who use each of the four device types regularly to stream content.

While smartphone is the ubiquitous device for streaming, a healthy 36% usage of Connected TV is an important finding. This amounts to about 32 Million SVOD 15+ Urban audiences in India. Add to this kids, rural audiences, and AVOD audiences, and we would hit a figure of about 65-70 Million audiences who are using Connected TV to watch streaming content. At an average incidence of 3.5 family members watching streaming content on Connected TVs, this amounts to 18-19 Million TV sets that are being used to stream content, along with (or instead of) linear television consumption. (The number of Connected TVs sold would be higher, as many TV sets that are capable of streaming are never actually used for that purpose)

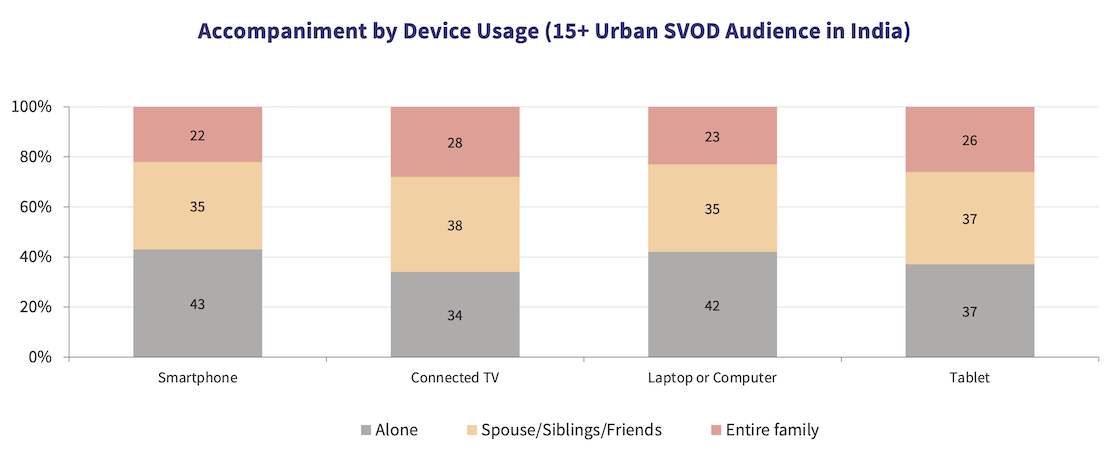

If we look at the accompaniment data for 2024 by the user base of different devices (chart below), the impact of Connected TVs can be clearly felt. The 43-57 solo vs. collective division changes to 34-66 for the audiences who use Connected TVs. It is important to clarify that the content being streamed on Connected TVs by SVOD audiences could often be AVOD content, such as YouTube or catch-up TV.

In effect, the pace at which Connected TV consumption can grow will determine how pay streaming can move towards collective consumption. And as that begins to happen, the nature of audience expectations from SVOD content will evolve as well. As it is, 2024 saw a stagnation in the SVOD audience base in India, highlighting low willingness to pay for SVOD apps outside the top cities, which have reached saturation levels. The growth in Connected TV consumption could arguably persuade AVOD families to take an odd subscription or two. But that's a stretch, given that it involves multiple variables ranging from pricing to content choices. But within the existing SVOD audience base, the growth in co-viewing, fuelled by higher usage of Connected TV sets, will compel leading SVOD platforms to rethink their content and marketing strategies, to make them more age and family-inclusive.

While streaming has its task cut out, this slow but emerging trend should worry linear television executives. The category has been 'safe' in India, primarily because of its monopolisation over 'family viewing'. If that changes, we could see attrition at much faster rates than currently, and cord-cutting, so far an Western idea that has been over-hyped in India, may be an actual thing to contend with.

Introducing Ormax Media Affluence (OMA)

OMA is a new audience classification system designed specifically to measure affluence level of audiences in context of the media & entertainment sector in India

From CTV to Micro Dramas: India's fascinating OTT spectrum

The simultaneous rise of Connected TV and Micro Drama audiences in India over the last year highlights how the Indian OTT market is expanding at both the premium and the mass ends simultaneously

Product update: Content testing for the horror genre

Based on our accumulated audience insights, we are introducing genre-specific drivers for horror films and series in our content testing tools, Ormax Moviescope and Ormax Stream Test

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy