When Hindi cinema struggled in 2022, with a string of high-profile films under-performing, the narrative that high ticket prices are dissuading audiences from going to movie theatres, began to find traction in the media and the film trade. This narrative was essentially based on what can, at best, be called a common-sensical hypothesis, that in a price-sensitive country like India (a well-known marketing truth for years now), high ticket prices are a significant barrier that prevents more audiences from going to the theatres, or the same audience from going more frequently.

But the question that remained largely unanswered was: What is the “high” level of ticket price where this barrier is triggered for a significant section of audience?

With the success of Pathaan, which operated on premium ticket rates for its first 12 days, this question becomes even more relevant. It is evident that what may be too “high” for a mid-range film may not be high at all for a big-ticket entertainer like Pathaan. And yet, the question remains: What is too “high” for a mid-range film? What is too “high” for a film like Pathaan?

Over the four-month period from August to November 2022, we collected extensive data to build deeper understanding of this topic. Here’s what we found out.

Methodology

We used Appeal, a parameter we report everyday across nine languages in Ormax Cinematix, as the central measure of analysis. Appeal is defined as the percentage audience, among those aware of a film, who are “definitely interested” in watching the film in a theatre. Appeal is a strong indicator of the creative strength of the campaign, i.e., the collective pull of the film’s cast, genre, music, scale, etc., as communicated via the various assets in the campaign.

In economic terms, Appeal is a crucial input that determines the demand a film creates for itself, ahead of its release. A strong campaign, especially when backed by good cast, can create high Appeal, e.g., Pathaan’s Appeal stayed in the 70s throughout the campaign period. A weak trailer can restrict Appeal and hence the demand for the film, e.g., Laal Singh Chaddha and Cirkus struggled to touch the 50-level, despite good cast and credentials backing these films.

In our research, we studied two types of Hindi films: Event films (such as Pathaan and Tiger 3) and Regular films (such as Bhediya and Shehzada). Each film’s Appeal was measured at different ticket price levels, starting from ₹50 to ₹400. This data was collected before the film’s first teaser or trailer was released. Audiences were cued a brief concept note of the film, along with a poster available in the public domain, and asked if they are interested in watching the film at a particular ticket price. For example, if 500 audiences answered the question for Pathaan at ₹50, a different 500 (but with the same demographic and geographic profile) answered at ₹75, and so on, till ₹400.

The Results

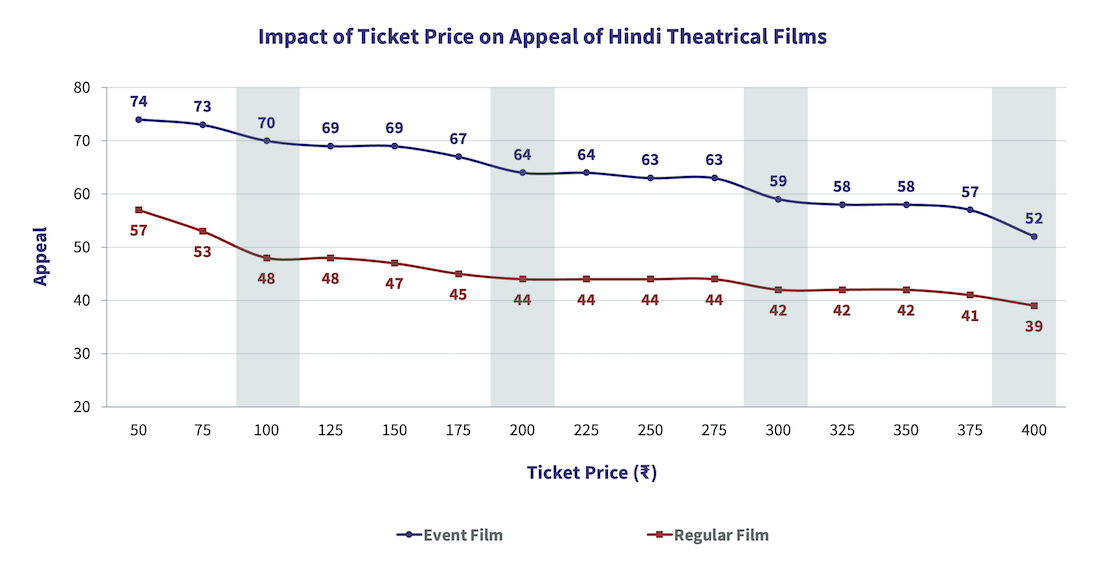

The chart below shows the impact of ticket price on Appeal for Event (blue line) and Regular (red line) Hindi films.

There’s a lot one can infer from this chart. Here are some of my observations:

1. Appeal for an event film at ₹375 ticket price is the same as that for a Regular film at ₹50 ticket price. This clearly highlights how ticket price for movies cannot follow a one-size-fits-all approach.

2. The Appeal tends to stay stable as the ticket price goes up in multiples of ₹25, but drops significantly when the hundreds digit takes a higher value. For example, for an Event film, it reduces only by 1 point (64 to 63) from ₹200 till ₹275, but reduces 4 points when the ticket price increases from 275 to 300. The green bands in the chart highlight these trigger points. This is the good old psychological pricing (or “charm prices”) at play, the likes of which dollar stores and brands like Bata have used over the years.

3. A mid-range (Regular) film loses maximum demand from ₹50 to ₹100, but then is then largely static on Appeal, dropping by an odd point here and there, on the way from ₹100 to ₹400. The loss of demand when the ticket price becomes double-digit is the section of about 10% audiences who would rather skip such films, unless they can be watched at throwaway prices. But no such dip is seen for Event films.

4. ₹400 emerges as a prohibitive price point. This, of course, is based on a national average for the Hindi audience, and the exercise can be replicated for different markets. For example, what is ₹400 here can be ₹600 for Mumbai, but ₹300 for Lucknow, and so on.

More than anything else, the findings tell us that beyond certain boundary conditions, a film’s demand is not too sensitive to its ticket price. And that’s not entirely surprising, if you see Hindi cinema-going experience as a “luxury”, than an affordable, inclusive experience, like visiting your friendly neighborhood Udipi joint, or hailing a metro train. Of course, that can open up a whole new debate on what will it take to ‘massify’ the theatrical medium for the Hindi market. But that’s a social debate first, and then one where content, distribution and pricing come into play. And that would need (and deserve) a different research of its own.

Ormax Cinematix's FBO: Accuracy update (December 2025)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major December 2025 releases vis-à-vis their actual box-office openings

The India Box Office Report: November 2025

November 2025 was an underwhelming month at the India Box Office, recording only ₹587 Cr in gross collections. However, the year stays on course to become the highest-grossing year of all time

Ormax Cinematix's FBO: Accuracy update (November 2025)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major November 2025 releases vis-à-vis their actual box-office openings

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy