By Our Insights Desk

Launched in 2010, Ormax Cinematix (OCX) is our proprietary campaign tracking and forecasting tool for theatrical film releases in nine major languages, tracking over 750 films every year. OCX surveys 2,000 theatre-going audiences every week, capturing their engagement with upcoming releases through three key parameters: Buzz, Reach, and Appeal. This data, when combined with market factors such as release scale, ticket price, and holiday release, is used to forecast the first-day box office (domestic) of the tracked films. This parameter, known as FBO serves as the cornerstone of OCX, relied upon by numerous subscribers across languages. Last year, we published this explainer, addressing 12 frequently-asked questions about FBO.

Box office forecasting is complex, involving an interplay of over 20 variables across both demand and supply sides. The comparison between FBO and actual film openings has sparked considerable discussion within the Indian film industry. At times, perceptions of a film’s ‘accuracy’ emerge more from hearsay than from actual data, as OCX reports are still widely pirated in the industry despite our efforts to curb this practice.

In light of this, we started a monthly blog from October 2024, which compares the forecast (FBO) with the actual openings of major films released each month. Actual box office data can vary by source, so Ormax generates its own estimates using a mix of reliable industry sources. These estimates will serve as the source for actual first-day box office numbers in this blog too. For questions about OCX or the box office figures in this blog, you can reach us at [email protected].

This is the January 2025 edition of this blog. Please use this link to download a summary of FBO vs. Actual comparison for all major January 2025 releases in India.

Major Hindi Films

Over the last two years, there has been a growing trend of ticket discounting via offers and coupons, which our forecast model is slowly learning to handle. However, there are also instances of "corporate booking", which refers to the producer or their affiliates buying tickets, to boost the box office of the film. Sometimes, these tickets are given out as freebies, and at other times, they are not used at all, which means that tickets are "sold", but there are no commensurate footfalls. Our forecast model is not designed to handle this inorganic boost to the box office. In the case of the January release Sky Force, both ticket discounting and corporate booking impacted the film's opening. The film was tracking at ₹7-8 Cr (nett domestic) through its campaign period, but inorganic interventions meant it opened at ₹13 Cr+. For this reason, the film has not been reported in this accuracy tracker.

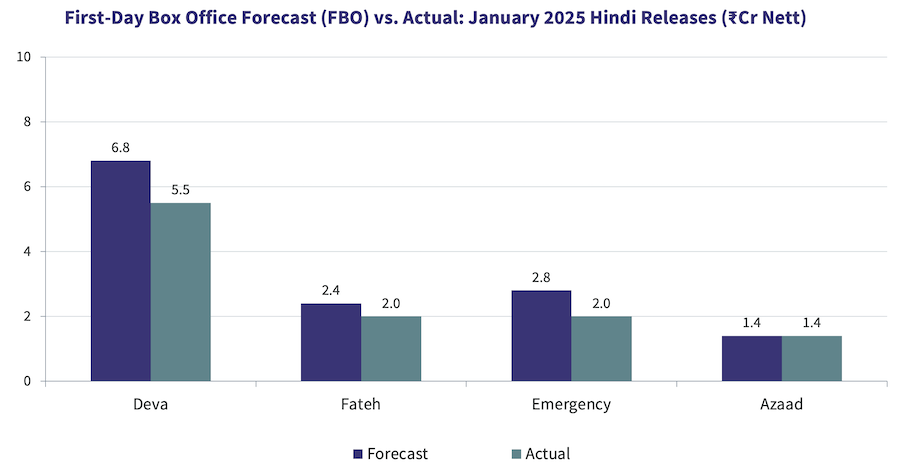

The forecasted vs. actual first-day box office of the other four major Hindi releases of the month have been reported below.

Deva finished about 20% less than our forecast on its opening day, highlighting how mid-range Hindi releases are increasingly finding it hard to open well. Emergency's ₹2 Cr opening is the first concrete sign that frequent use of 'Cinema Day' offers has now made the ticket-discounting idea less effective.

Pan-India film Game Changer

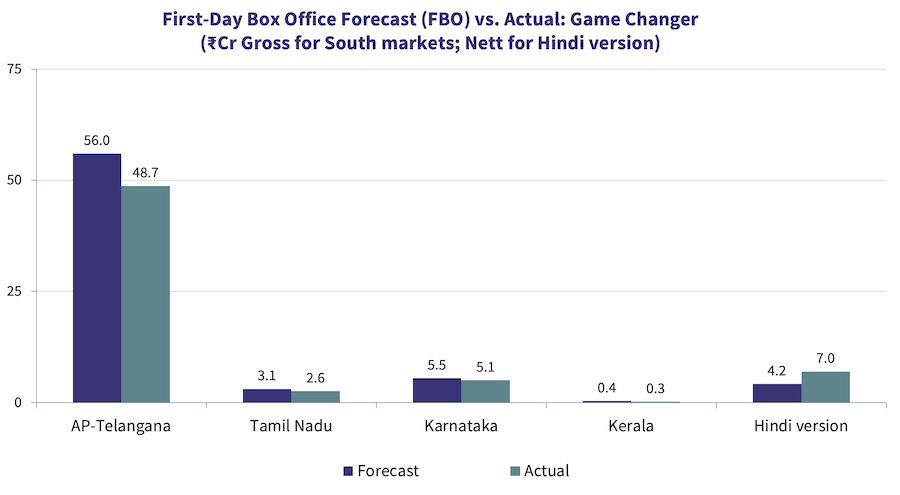

Ram Charan starrer Game Changer enjoyed a good pan-India release. The Hindi version outperformed the forecast. Here too, there was an inorganic factor that boosted the collections. However, the degree of this boost wasn't as significant as Sky Force, and hence, the film has been considered in this tracker.

The Telugu version underperformed by 15%, primarily because of poor audience word-of-mouth, which tends to come into effect on the first day itself for big releases in the South market.

Other South Indian Language Films

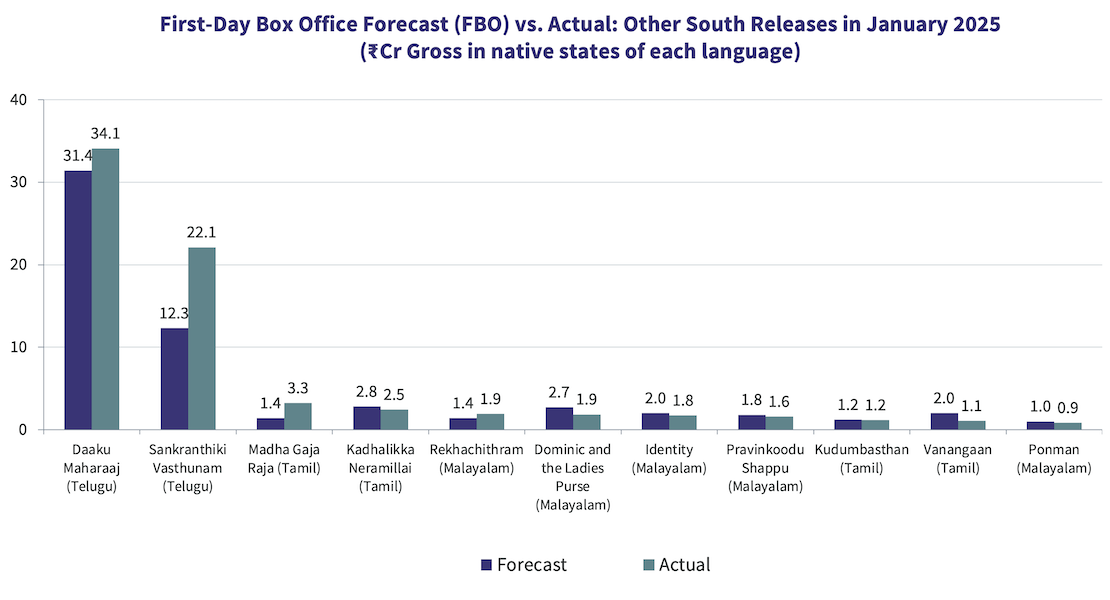

Given the Sankranthi and Pongal period, January 2025 saw a slew of releases in the South markets, including releases on Saturdays and holidays. The forecast for the other major Telugu release after Game Changer, i.e., Daaku Maharaaj, was accurate, with just 8% deviation vis-à-vis actual. However, family comedy Sankranthiki Vasthunam outperformed its forecast by a sizeable margin. Our forecast model is going to benefit from the multiple festive releases in January 2025, while forecasting the opening of subsuqent festive releases in the South markets. Meanwhile, here's an analysis on the genre-defying success of Sankranthiki Vasthunam.

Note: There were no major releases in the other languages in which OCX tracks films, i.e., Hollywood, Marathi, Punjabi, and Bengali, in January 2025.

Ormax Cinematix's FBO: Accuracy update (November 2025)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major November 2025 releases vis-à-vis their actual box-office openings

Product update: Content testing for the horror genre

Based on our accumulated audience insights, we are introducing genre-specific drivers for horror films and series in our content testing tools, Ormax Moviescope and Ormax Stream Test

The India Box Office Report: October 2025

Driven by Kantara - A Legend: Chapter-1, October 2025 has emerged as the highest-grossing box office month of the year at the India box office, with gross collections of ₹1,669 Cr

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy