By Amit Bhatia

Over the last two years, the term 'Pan India film' has been used casually for every other film that has been released in a dubbed version in Hindi. Dubbed Hindi releases of films originally made in South Indian languages were far and few in between till before the pandemic. They were simply referred to as dubbed versions of the original film. The term 'Pan India' suggests universal acceptance from the audience across the country. By calling a film 'Pan India' only because it's being released in Hindi (apart from other South Indian languages other than the original) is, hence, presumptive.

The trend of releasing dubbed Hindi versions of films from the South is an idea that can be traced back to Bahubali’s humongous success in 2015. While there have been dubbed Hindi releases before that too, it was Bahubali: The Beginning crossing the 100 Cr mark that made dubbed films look like a mainstream option. That film was followed by Bahubali 2: The Conclusion (2017), which went on to become the biggest 'Hindi' film of all time, till Pathaan broke that record earlier this year. K.G.F: Chapter 1 went on to do good business in late 2018. But there wasn't much else that worked in this space besides these three films.

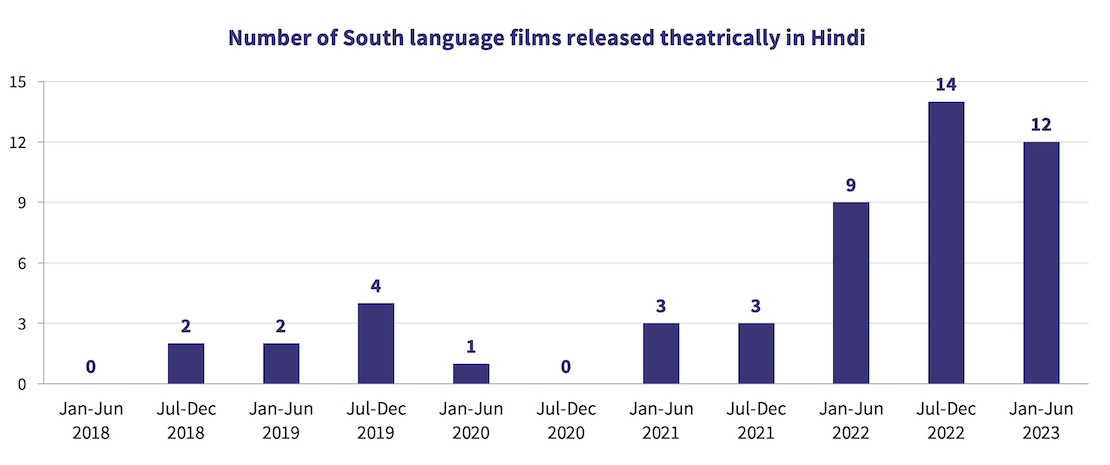

The pandemic that followed led to the audience getting exposed to content in different languages. That led film-makers and actors in the South to think that there's a market for their films beyond the South, especially because many Hindi films were struggling in the post-pandemic period. With the success of Pushpa - The Rise in late 2021, their case strengthened. In the first half of 2022, K.G.F: Chapter 2 and RRR further amplified the perception that the Hindi audience is ready to accept films from South India wholeheartedly. The chart below captures the number of films in South Indian languages that were dubbed and released in theatres in Hindi since 2018, on a half-yearly basis. Bilinguals whose major market is in the South, such as Rocketry and Radhe Shyam, have been included in the list.

From only six films in 2019, the number of South dubs releasing in Hindi has increased to 23 in 2022, and is certain to go up further in 2023, with the first half already seeing 12 such releases. Today, most major South Indian films are being marketed as Pan India films as early as at the time of project announcement. The term 'Pan India' is not a consumer or a box office term anymore. It's simply an articulation of the ambition of a producer or a star to find an audience base in the Hindi markets.

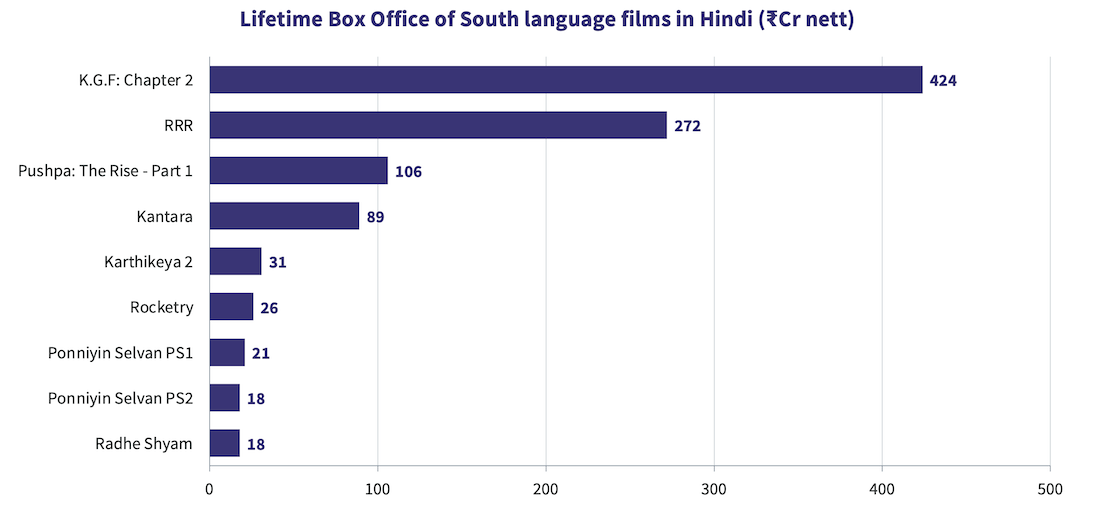

While the number of such releases have more than quadrupled, the box office performance of these Hindi dubs does not build a strong case for many of them to be released in Hindi in the first place. Out of 42 Hindi dubs released from Jan 2020 till Aug 2023, only nine films (see chart below) managed to cross a lifetime box office of ₹15 Cr nett in Hindi. ₹15 Cr is not a big number by any means, but even this modest benchmark has been achieved by only 21% of the films that have attempted to flirt with the Hindi market. Even the recently released Jailer, which has been a blockbuster in Tamil, and done very well in the other South markets too, will end up with a lifetime box office of only about ₹2-3 Cr in the Hindi dubbed version.

It's hard to spot a pattern in these nine films, on first sight at least. The presence of big star names is certainly not the common factor, with Kantara and Karthikeya 2 on the list, while films like Varisu, Master, Waltair Veerayya, and Akhanda failing to find a sizeable Hindi audience.

From the genre or scale point of view, the theory that only mass action films like K.G.F: Chapter 2 and Pushpa: The Rise deliver in the Hindi markets is not validated, with Kantara, Karthikeya 2 and Rocketry - The Nambi Effect delivering from different, non-action genres. If there's a pattern at all, it seems to lie in the uniqueness of themes that these films offer, suggesting that variety and freshness, and not star power, action or scale, holds the key. But freshness is a subjective idea, and every producer would like to believe their next film is high on it.

In the absence of a discernable trend, releasing a film in a Hindi dubbed versions seems like a shot in the dark. Many of these films are not even marketed well, with the Hindi trailer releasing only a few days before the film’s release. Some don’t even get proper showcasing. For example, the Hindi version of the recent Telugu film Spy did not get a release in the major multiplex chains.

It seems that these films are being released in Hindi in the hope that they could be the next Kantara or the next Karthikeya 2. Encouraged by limited costs of distribution (the film has to be anyway dubbed for OTT and satellite), producers are throwing everything at the wall, waiting for something to stick.

An interesting aspect that could be encouraging producers and distributors to release so many films in Hindi is that some of the successful films did not get a good opening, but grew organically through audience appreciation. Even Pushpa, which was a breakout success in Hindi, opened at only about ₹3.5 Cr on its first day. As a result, there is less pressure to market these films aggressively to the Hindi audiences. If the content finds an audience, the film can build on that strength, often recording a second week higher than the first.

On the other hand, some producers have taken a more aggressive approach in releasing their films in Hindi, by including cameos of big Hindi film stars in the film (e.g., Salman Khan in Godfather), or using Hindi film stars to promote their films, such as Salman Khan promoting Vikrant Rona (picture below). These attempts, however, have not managed to draw in the audience at all.

Cheers to my talented friend Lokesh @Dir_Lokesh and the Legend of Indian Cinema @ikamalhaasan ! This trailer is fire https://t.co/w1ScXKUrrc

— Ranveer Singh (@RanveerOfficial) May 19, 2022

Happy to launch the trailer of #MajorTheFilm. This looks outstanding. All the best to the team.#MajorTrailer

— Salman Khan (@BeingSalmanKhan) May 9, 2022

- https://t.co/QJV3CiLThf#MajorOnJune3rd #JaanDoongaDeshNahi@AdiviSesh @saieemmanjrekar @SashiTikka @urstrulyMahesh @sonypicsfilmsin @GMBents @AplusSMovies pic.twitter.com/l8joQ1ujMs

Pan India films are a gamble that's relying on hope and optimism. With original Hindi films finding their groove too in recent months, we can expect better sense to prevail, and the Pan India trend to correct itself in the coming year.

Ormax Cinematix's FBO: Accuracy update (February 2026)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major February 2026 releases vis-à-vis their actual box-office openings

OWomaniya! 2025: Quantifying gender diversity in Indian entertainment

The fifth edition of the OWomaniya! report by Ormax Media & Film Companion Studios, presented by Prime Video, reveals glaring statistics on gender disparity in the Indian entertainment industry

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy