Ormax Stream Track is Ormax Media's tracking tool for new streaming (OTT) launches in India. Since its launch in April 2020, the tool has tracked more than 1,200 launches across major streaming platforms, including original shows, direct-to-OTT films, unscripted shows, and the streaming launch of theatrical films. Being an audience track with a national coverage, Ormax Stream Track focuses on Hindi, English, and International launches, including Hindi dubbed versions of major properties from South Indian languages. We run custom tracks for various platforms catering specifically to Tamil, Telugu, Malayalam, Kannada, Bengali and other such language markets.

Over its first four years, Ormax Stream Track reported three parameters for all properties being tracked, namely Buzz, Reach & Appeal. These somewhat self-explanatory parameters are borrowed from our theatrical tracking tool Ormax Cinematix. Buzz and Reach are awareness variables, and reflect the spontaneous awareness (talk value) and reach of the property respectively, while Appeal is a measure of the intention to sample the content, in effect reflecting the strength of the creative assets of the property.

Ormax Stream Track has received immense traction in the Indian OTT space, and is now the go-to tool to measure marketing performance of new launches across all major streamers in India. As is the case with all our tools, we are constantly seeking ways to improve them, towards better usability in the marketplace. In June 2024, a significant update on Ormax Stream Track came in the form of introduction of a new parameter called Potency.

What is 'Potency'?

Potency is defined as a score on a 0-100 scale that measures % audience who are interested in subscribing to a pay (SVOD) platform specifically to watch it. In effect, Potency is a measure of the efficacy of a show/ film to drive new subscriptions/ renewals. It is a significant business parameter, and was instantly appreciated upon its introduction to Ormax Stream Track in June this year.

Since its introduction, Potency has been tracked for 140 SVOD properties so far, giving us sizeable data to analyse trends.

Potency Benchmarking

Of the 140 properties tracked on Potency, 22 managed to achieve a Potency of 20% in at least one week of tracking. This amounts to 16% of the total number of properties tracked. If we relax the benchmark to a Potency of 15%, the number of properties increases to 41, i.e., 29% of all properties tracked.

20% itself is not a very stringent benchmark, and for the purpose of the rest of the analysis, we will consider this threshold as a benchmark of good Potency.

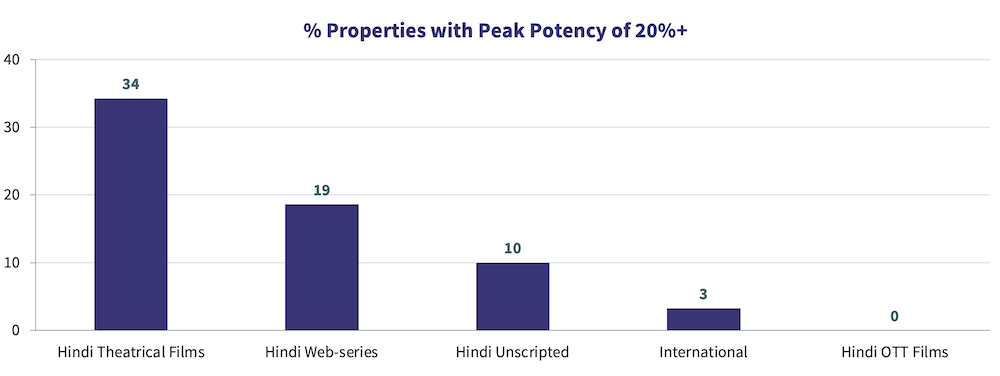

So how does this proportion (% properties with a Potency of 20%+ in at least one week) vary for different types of content? The chart below illustrates this comparison. 'Hindi' includes Hindi dubbed versions of major series/films from other Indian languages, where a Hindi language marketing campaign was prominently executed.

It's evident that Potency is heavily skewed towards theatrical content, vis-a-vis web originals. Interestingly, all the nine web originals (7 Hindi web-series, 1 Hindi unscriped & 1 International) that managed to touch the 20% mark on Potency are established franchise properties. The highest Potency for any non-franchise web original stands at 18%, achieved by Netflix's original film Sector 36.

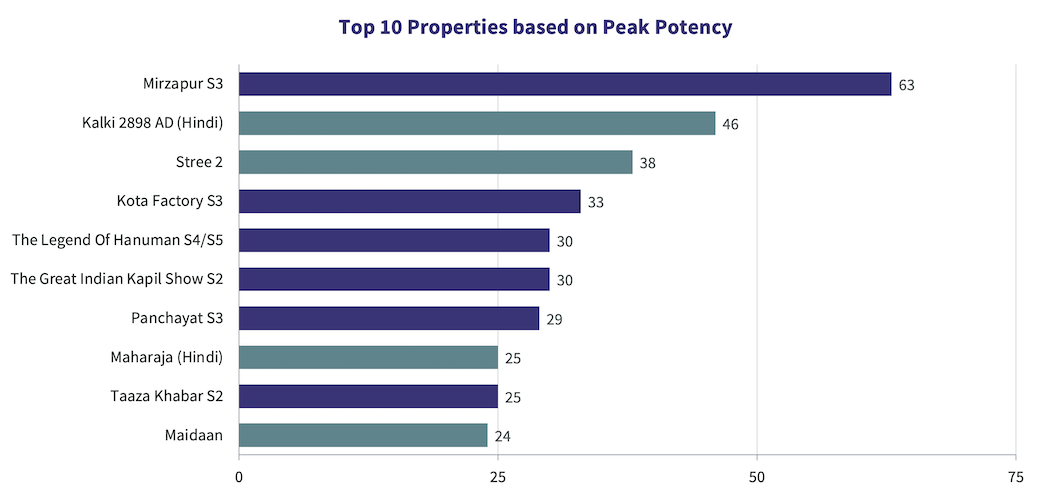

The chart below lists the top 10 properties on Potency, and the dominant presence of theatrical films (in green) and established web franchises (in blue) is evident from it. Maharaja (Hindi) refers to the Hindi dubbed version of Tamil film starring Vijay Sethupathi, not the direct-to-OTT film Maharaj on Netflix.

Implications

What does the first four months of Potency data tell us? Here are three observations:

1. Standalone (non-franchise) web originals are unlikely to emerge as acquisition drivers, unless they are exceptionally strong on word-of-mouth, or have a big starcast backing them. Early part of 2024 saw the launch of two such properties (Heeramandi and Indian Police Force), which had scale and cast, but no franchise support. Since the Potency parameter did not exist then, it is difficult to say whether these properties would have met the 20% benchmark. But since mid-June 2024, no non-franchise web original has managed this. In effect, franchise building is of critical importance, and the job of the first season is to create a strong franchise, which can then be leveraged in subsequent seasons from a monetization perspective.

2. To achieve the above, pre-testing non-franchise content in particular holds significant value. Originals with an Ormax Power Rating (OPR) of less than 58 rarely get renewed for a second season, simply because their performance is limited by mixed to negative audience feedback. Thus, by pre-testing content, the platform is not only being able to estimate the likely performance of the show/ film, but equally, they are being able to see if it has franchise potential to begin with. And as seen in the Potency analysis above, franchise potential and monetization are strongly linked.

3. Acquisition of theatrical films is an expensive but 'potent' strategic choice that platforms can make. Even mid-range films (Kill, Munjya, Mr. & Mrs. Mahi, Srikanth, Crew, etc.) managed to cross the 20% mark on Potency. So, one doesn't need to go after only the Pathaans, the Jawans, or the Animals. Many films, including those from the South (which Ormax Stream Track reports only from a national perspective) can play a strategic role in new customer acquisition.

If you have queries related to Potency in specific or Ormax Stream Track in general, we will be happy to connect with you.

Top 50 streaming originals in India: The 2025 story

Our year-end report looks at the Top 50 most-watched originals on streaming platforms in India in 2025

Product launch: Ormax StreamView

Our new weekly tracker is designed to answer a simple, high-stakes question for the Indian media and advertising ecosystem: “What is India watching on OTT?”

Introducing Ormax Media Affluence (OMA)

OMA is a new audience classification system designed specifically to measure affluence level of audiences in context of the media & entertainment sector in India

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy