By Our Insights Desk

Data for the first edition of Sizing The Cinema, our research report to size India's theatre-going universe (defined as those who watched at least one movie in a theatre in the last 12 months), was collected in Jan-Mar 2020, coincidentally just before the onset of the pandemic (details here). After nearly two years of disruption, theatrical business found its footing again in 2022 (see our annual box office report). In Jan 2023, we conducted the second round of the Sizing The Cinema research, this time with an even-bigger sample size of 15,000 respondents across India (compared to 5,600 in the pre-pandemic report), to understand the changes in the universe.

Unlike the 2020 report, the full version of the 2023 report is available by paid subscription. You can email us at [email protected] for details. Here are some highlights:

India's theatrical universe shrunk by 16.3% compared to pre-pandemic, and now stands at 122.0 Million individuals, compared to 145.7 Million pre-pandemic. This drop is not entirely surprising, given that the medium faced severe disruption during the pandemic, more than any other medium. With ticket prices going up, the drop in footfalls, as seen in the annual box office report linked above, from 2019 to 2022, is less severe at 13.4%. 2022 generated 892.2 Million footfalls in India, which means that an average member of India's theatre-going universe watched 7.3 films in a theatre in 2022. These numbers are across languages, with an average Indian theatre-goer watching films in 1.5 languages in 2022.

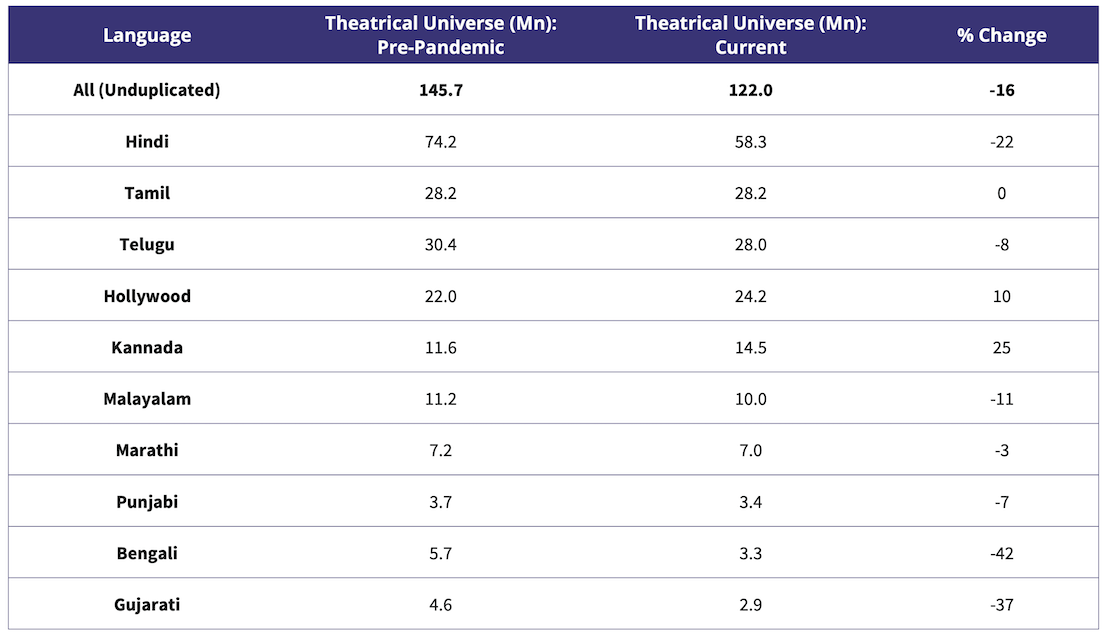

Interestingly, the drop in India's theatrical universe varies significantly by language. The table below summarises this:

Hindi language has seen a sizeable drop, of 22%, having lost 15.9 Million audiences over the pandemic period. The South languages, in contrast, have managed to hold on to their respective audience bases much better, with marginal drops in Telugu and Malayalam, no change in Tamil, and a sharp 25% growth in the Kannada universe.

At 122.0 Million, only 8.6% of India visited a theatre at least once in the previous year (2022 in this case), down from 10.5% pre-pandemic. In either case, theatrical penetration in India is low. India's theatrical universe is roughly similar in size to India's SVOD universe, but only about a quarter of India's overall OTT (SVOD+AVOD) universe (see highlights from our OTT sizing report for comparison).

2023 has started off on a good note with Pathaan. We will continue to track all aspects of the Indian box office market over the course of this year. Watch this space for more updates.

Ormax Cinematix's FBO: Accuracy update (February 2026)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major February 2026 releases vis-à-vis their actual box-office openings

OWomaniya! 2025: Quantifying gender diversity in Indian entertainment

The fifth edition of the OWomaniya! report by Ormax Media & Film Companion Studios, presented by Prime Video, reveals glaring statistics on gender disparity in the Indian entertainment industry

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy