By Our Insights Desk

We publish regular reports on the Indian streaming landscape, looking at content, platforms, and audiences from different perspectives. Our year-end report, titled Streaming Originals in India: The 2024 Story, was released recently, and can be downloaded here. Most such reports look at the streaming category from an audience or demand-side perspective. But looking at the category from the supply side can be equally interesting. The analysis that follows looks at the number of streaming originals in India over the years, and their breakup by platforms, languages, and formats, to build an understanding of how the landscape is shaping up from a content perspective.

The analysis is based on a count of streaming or OTT originals launched in India across all major platforms, excluding YouTube. While we have scanned the ecosystem thoroughly, there may still be some low-key, unpromoted launches that our research has missed. Different seasons of the same property have been considered as separate entries, even if launching in the same year. However, staggered launches (e.g., a show launched in two parts) have been considered as a single entry. ‘Hinglish’ content, as well as multi-lingual content where Hindi is the primary language of consumption, has been classified as Hindi in this analysis. Comedy specials have been included under the format 'reality shows'. International content has been excluded from this analysis, which focuses only on content produced in India.

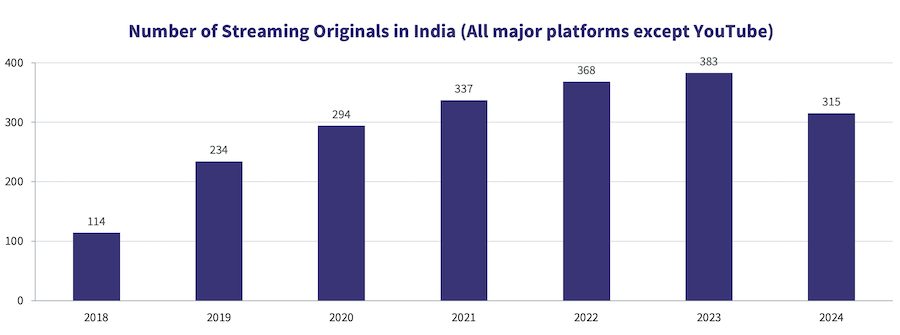

The chart below captures the number of streaming originals in India year-on-year, from 2018 to 2024, across languages, platforms, and formats.

After peaking in 2023 at 383 properties, the category witnessed an 18% drop in the number of originals that launched in 2024, highlighting a slowdown. The 2024 number is the lowest across all post-pandemic years, i.e., 2021 to 2023.

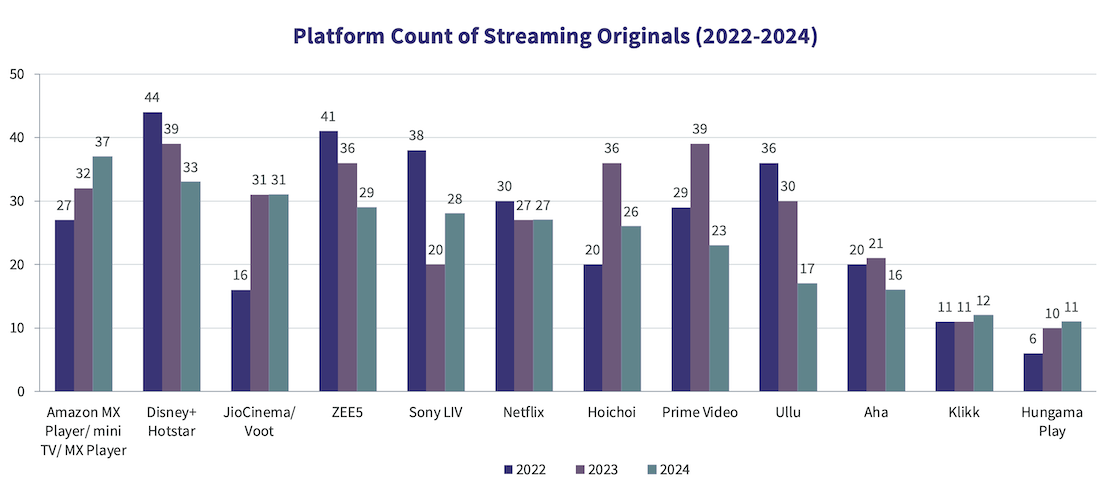

Next, we look at how the count of originals varies by platforms. All platforms that had 10 or more originals launched in 2024 have been depicted in the chart below.

The 18% drop in supply in 2024 can be attributed to reduction in number of originals on Prime Video, Ullu, Hoichoi, and ALTT (drop of 10+ nos.), followed by ZEE5, Disney+ Hotstar, Aha, Addatimes, and Discovery+ (drop of 5-9 nos.). Amazon MX Player and Sony LIV launched more originals in 2024 compared to 2023, while Netflix and JioCinema maintained their 2023 count in 2024 as well.

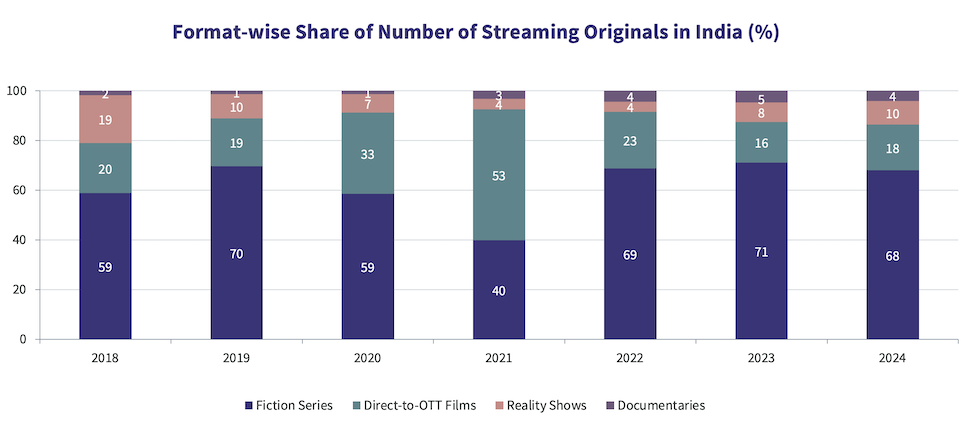

From a format perspective, the content can be divided into four categories: fiction Series, direct-to-OTT films, reality shows, and documentaries. The chart below has the year-on-year percentage contribution of these four categories to the number of streaming originals in India.

Direct-to-OTT films had significant presence in 2021, because many theatrical films took the OTT route, because of prolonged closure of theatres during the pandemic. However, since 2022, fiction series continue to be the dominant format, with its share hovering around the 70% mark. 214 of the 315 originals launched in 2024 were fiction series. The equivalent number was 272 in 2023, i.e., a drop of 21%.

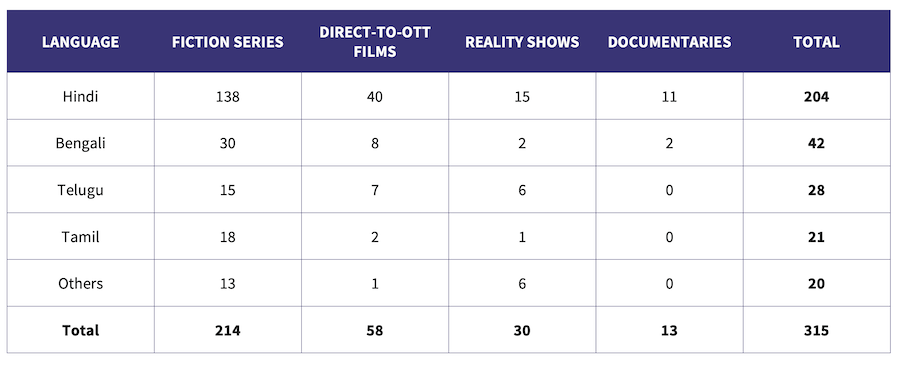

The table below has the format and language-wise breakup of the 315 originals launched in 2024.

Hindi remains the dominant language, accounting for 65% of streaming originals in India in 2024. Bengali taking the no. 2 spot is a function of the presence of three major language-specific players. Category leader Hoichoi is a well-entrenched platform, while Kilkk and Addatimes have been fairly active too.

Telugu and Tamil languages saw 20+ originals each in 2024, with language-focused platform Aha, and national platform Disney+ Hotstar, accounting for 17 out of 21 (Telugu) and 14 out of 20 (Tamil) launches between them.

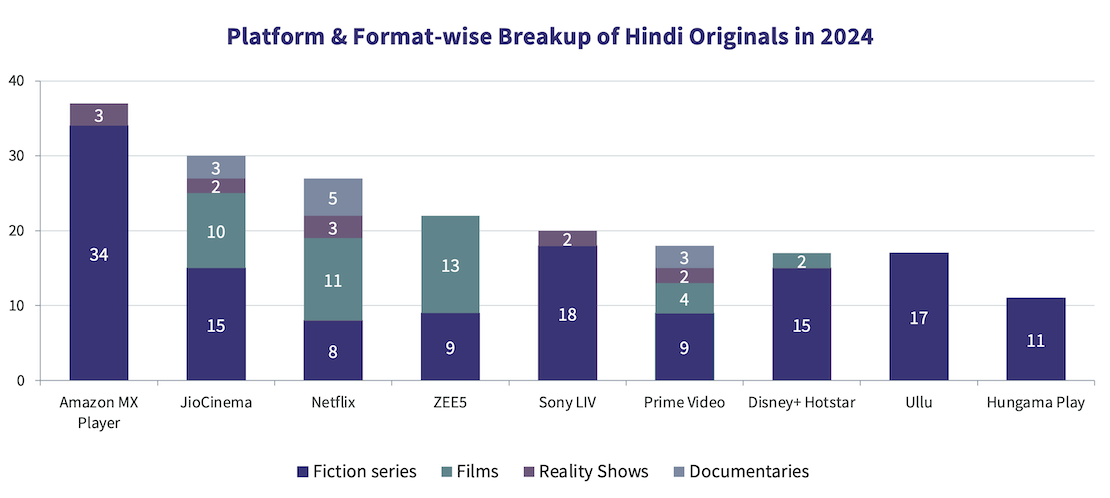

Next, we look at the format-wise breakup of originals by different platforms for originals in the Hindi (or 'Hinglish') language.

Interestingly, the content strategies vary significantly by platform. Amazon MX Player, Sony LIV, Disney+ Hotstar, Ullu, and Hungama Play focused primary on fiction series for their Hindi content. ZEE5 launched the highest number of direct-to-OTT films in India, prioritising the format over web-series. JioCinema, Netflix, and Prime Video had the most balanced content offerings, with representation from all four formats.

This analysis does not look at another important content type on OTT: Theatrical films. We will soon be a publishing a report on this website on which platforms are licensing theatrical films the most, for all major Indian languages.

Introducing Ormax Media Affluence (OMA)

OMA is a new audience classification system designed specifically to measure affluence level of audiences in context of the media & entertainment sector in India

From CTV to Micro Dramas: India's fascinating OTT spectrum

The simultaneous rise of Connected TV and Micro Drama audiences in India over the last year highlights how the Indian OTT market is expanding at both the premium and the mass ends simultaneously

Product update: Content testing for the horror genre

Based on our accumulated audience insights, we are introducing genre-specific drivers for horror films and series in our content testing tools, Ormax Moviescope and Ormax Stream Test

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy