The last three years have witnessed sharp growth in the OTT category in India, both in terms of the number of originals being produced, as well as the subscriber base of various platforms streaming this content. While a few platforms were already established in the marketplace before the pandemic, the category got a big boost during the lockdowns, and hasn't looked back since. This period has also been characterized by efforts taken by leading OTT platforms to build the equity of their respective brands, an exciting task in a fast-evolving category.

So far at least, marketing campaigns by OTT platforms have focused on their content, such as original series, films or sports. But is there a correlation between the quality and quantity of content, and brand equity? Does 'successful' content help build an OTT brand? Or is there more to brand-building in this category? We decided to seek some answers.

In October 2021, we had launched Ormax Brand Monitor (OBM), a monthly brand equity research for OTT platforms in India, to track the health of the brand on key metrics. OBM samples 2,000+ viewers of original OTT content in India every month, and reports the performance of leading OTT platform brands on an array of brand measures.

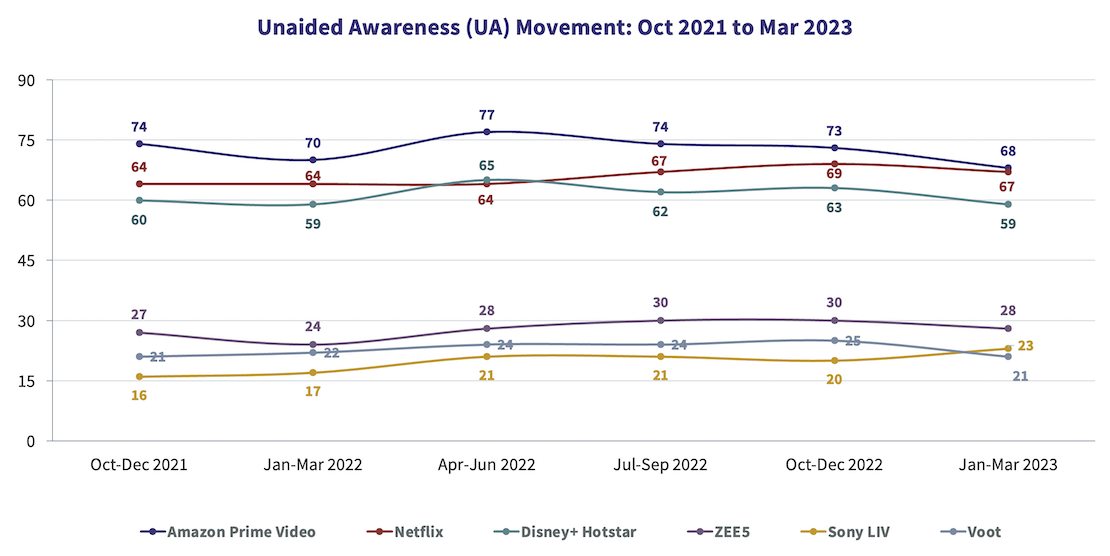

One such measure is Unaided Awareness (UA), defined as % target audience who named the brand, when asked to name all the OTT platforms they can recall. UA captures the buzz or the talk value that a brand has, and is a key concern for brand managers, especially in a cluttered category such as OTT in India.

The chart below depicts quarterly movement in UA for the top 6 SVOD (pay) platforms at an all-India level.

The flat lines tell a story of their own. Over 1.5 years, there has been very little change in the ranking or the relative performance of the six brands on this key measure. The story is not very different if one looks at other parameters such as Preference (i.e., favorite OTT platforms). It may, indeed, seem highly unusual that in a new and dynamic category, brand measures look so stable.

We mapped some of the big-ticket launches and specials on these platforms to see if there was an impact on any of the brand measures, including UA. Most of the time, the answer was "No". For example, with an Ormax Power Rating (OPR) of 75, Panchayat S2 was the most-liked Hindi original series of 2022. OPR is a measure of the likeability (word-of-mouth, as it's often called) of a show/ film among those who watched it. Panchayat S2 launched in May 2022. Amazon Prime Video's UA did not show any growth in the next quarter, and continued to hover around the mid-70s. The brand's Preference remained unchanged over three quarters (the one before the show's launch, the show launch quarter, and the one immediately after).

Disney+ Hotstar saw a minor spike in its UA in the IPL quarter in 2022, but the number eventually settled down to the pre-IPL level over the next two quarters. Netflix India's content in the last few months has performed better on viewership and OPR than the year before, but the UA has gone up only marginally, from 64 to 67-69.

The only brand that has seen some definitive positive movement, though at lower scores than the top 3 platforms on equity, is Sony LIV. The brand's UA (the yellow line in the chart above) has grown from 16% in Oct-Dec 2021 to 23% in the latest quarter, i.e., a growth of 44%.

Audience appreciation for Rocket Boys S1 (OPR 67), launched in February 2022, followed by Gullak S2 (OPR 64) in April 2022, enabled UA growth in the first two quarters of 2022. Subsequently, shows like Maharani S2 (OPR 62) and Rocket Boys S2 (OPR 63) have ensured sustenance. But Sony LIV has not relied only on originals. There has been a good mix of sporting properties (cricket as well as non-cricket) and non-fiction shows (especially KBC and Shark Tank India) to keep subscribers engaged via regular offerings.

But while there's some growth trend, the platform has not been able to break out of the second tier (which it now leads on several metrics) of brands. On Preference, the top 3 brands score in the 20-30% range, while second tier brands struggle to touch the 5% mark.

In September 2021, Shailesh Kapoor wrote an article on this website, titled Never let tech come in the way of a good story. The significance that OTT audience attach to technology-driven factors in an OTT platform's offering stands out as a key reason that is preventing the second tier of brands from closing the gap with the top 3.

Hence, while offering good content at regular intervals is indeed prudent, coupling it with a product that's strong on tech is needed for the brand experience to come alive. The flat-line chart above can be understood as an outcome of the tech side of this coupling remaining unchanged over the 1.5 years period for which OBM data is available.

As the category begins to prepare for more action with the launch of JioCinema, it may just be the time to focus on offering a holistic brand experience to users, than limiting the aspiration to offering compelling content.

Ormax Trac20: Ad & sponsorship effectiveness research for IPL 2026

Our new tool Ormax Trac20 combines weekly ad tracking and multi-stage brand lift diagnostics to help IPL 2026 sponsors & advertisers measure impact and optimise in-season performance

OWomaniya! 2025: Quantifying gender diversity in Indian entertainment

The fifth edition of the OWomaniya! report by Ormax Media & Film Companion Studios, presented by Prime Video, reveals glaring statistics on gender disparity in the Indian entertainment industry

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy