The success of K.G.F: Chapter 2 has emerged as the big entertainment headline of 2022 so far. The film has gone on to do exceptional box office in multiple markets, including overseas. In the Hindi language, the film is now the second biggest domestic grosser of all time, after Bahubali 2: The Conclusion. Both K.G.F: Chapter 2 and Bahubali 2 are films from Southern parts of India, made originally in Kannada and Telugu respectively. RRR, another Telugu film, is also a big grosser this year.

Doctor Strange: In The Multiverse Of Madness released this May to opening collections in India that no Hindi film has been able to achieve since the pandemic started. A large share (about 50%) of the film’s collections have come from the language-dubbed versions, i.e., Hindi, Tamil and Telugu.

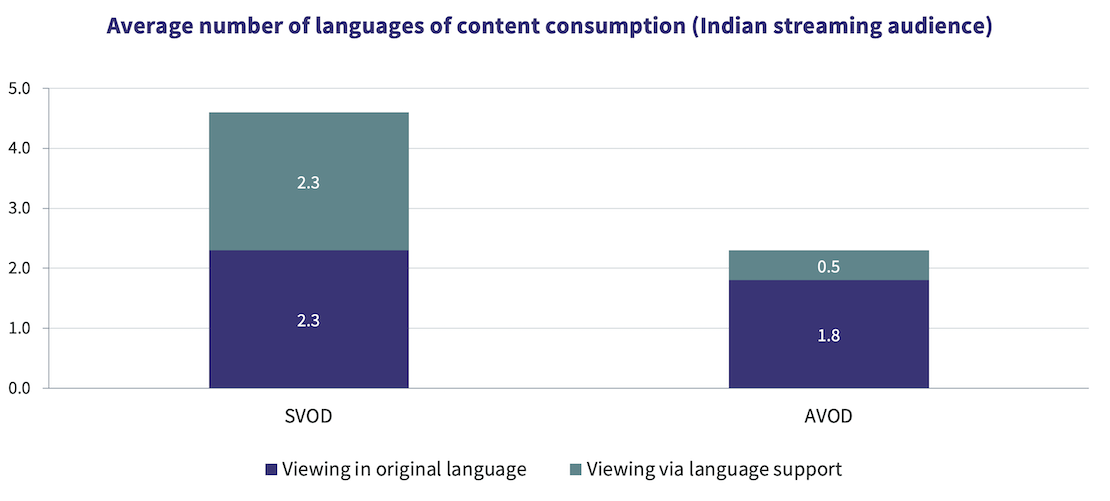

Can one call this the breaking of the ‘language barrier’? The Ormax OTT Audience Profiling Report 2022 reveals that a typical paid streaming audience (SVOD) is watching content in 2.3 languages, which they understand functionally at least. But if you include the languages in which dubbed or subtitled versions are being watched, this number doubles to 4.6. The equivalent numbers are 1.8 and 2.3 for AVOD audiences. The big difference is the D-word: Dubbing.

Dubbed content has been around in India for two decades now, with Hindi movie channels thriving on Hindi-dubbed versions of South Indian action films. These films found a core audience (typically men in the smaller towns and the lower socio-economic strata) over time, and the ratings from this core group fueled more acquisition and programming of such content over the years. Licensing fees of South Indian dubs have seen upward revision to the degree of 10X, perhaps even more, over the last 15 years.

But South dubs on Hindi movie channels were treated with a touch of condescension by the cosmopolitan audience, which includes the media fraternity, ranging from advertisers to Hindi-language content creators. “Set Max” (as Sony Max is popularly called) entered the pop culture for its love for such films, along with its love for Sooryavansham, a Hindi film that has its origins in the South of India too. There were ratings, but a perception of legitimacy, if one can call it that, was missing.

Things started to change around 2015, for two parallel, unrelated reasons. The first reason was the Bahubali franchise. The first Bahubali film that year raised the bar on South Indian dubbed content overnight, and by several notches. Around the same time, the Marvel Cinematic Universe had started building a loyal teenage and youth fanbase in India, leading to dramatic growth in Hollywood box office in India, which has multiplied by a factor of 3 from 2014 to 2019.

The next big boost came during the pandemic, when streaming consumption skyrocketed, and a large section of audience started sampling content (both films and series) in non-native languages, via language support. This included not just Indian languages and English, but also other foreign languages like Korean, Spanish, German, etc. The Spanish series Money Heist was the most-watched Netflix content in India in 2021, ahead of all Indian series and films. Money Heist is available to watch in English, Hindi, Tamil & Telugu in the India market.

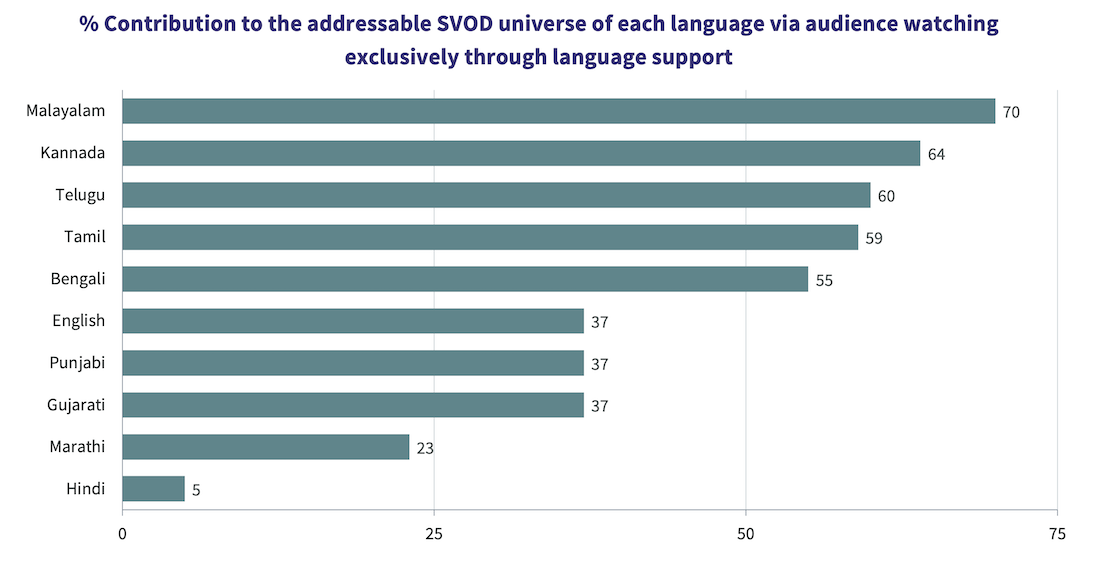

The chart below, also from The Ormax OTT Audience Profiling Report 2022, summarizes the growing importance of dubbed content in India. 70% audience of Malayalam content on paid streaming platforms are exclusively through language support. “Exclusively” here means that these audience do not understand the language at all, and must rely on language support (which includes subtitling, but is primarily driven by dubbing) to comprehend the content.

This proportion is 59%+ for the other three South Indian languages too, and a healthy 39% for English. The chart also shows how Hindi content has not managed to penetrate the South markets, with just 5% of Hindi content audience being those not familiar with Hindi. The Hindi film industry has been facing an identity crisis of sorts, as it sees Hollywood and South Indian films outperform, while big-ticket Hindi films struggle to find audience in their native markets, let alone down South in the dubbed versions.

But at a national level, the story is an emphatically positive one. Dubbing has unlocked a world of content that was hitherto inaccessible to the wider Indian audience. The possibility that the next big content wave may come from an unexpected part of India, or the world, is now a real one.

It doesn’t make the task of content creators any easier. But the audience is not complaining.

This article is an edited update of a column by the author on MXMIndia

To subscribe to The Ormax OTT Audience Report 2022, please drop in an email to [email protected], and we will connect with you soon.

OWomaniya! 2024: Quantifying gender diversity in Indian entertainment

The fourth edition of the OWomaniya! report by Ormax Media & Film Companion Studios, presented by Amazon Prime, reveals glaring statistics on gender disparity in the Indian entertainment industry

Content Testing: Frequently Asked Questions - Part 3

In the third and final edition of this explainer series, we continue to answer frequently-asked questions about our Content Testing work for theatrical, streaming and television domains

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy