By Our Insights Desk

There has been a popular perception in the Indian Media & Entertainment industry that English content targets only a segment of the Indian audience within the upper echelons of the socio-economic spectrum, and the word "niche" is often associated with English content, as a result. However, a deeper exploration of this topic, in our new whitepaper launched in collaboration with Sony Pictures Television, reveals another story.

The Ormax OTT Audience Profiling Report: 2022 estimates that there are a total of 85.2 Million adult (15+ yrs.) English content viewers in Urban India. This universe is equally split between SVOD (42.7 Mn) and AVOD (42.5 Mn) audience. The 42.7 Mn audience base constitutes 65% of the urban Indian SVOD audience (15+ yrs.), who watch English content, in English or in a language of their choice.

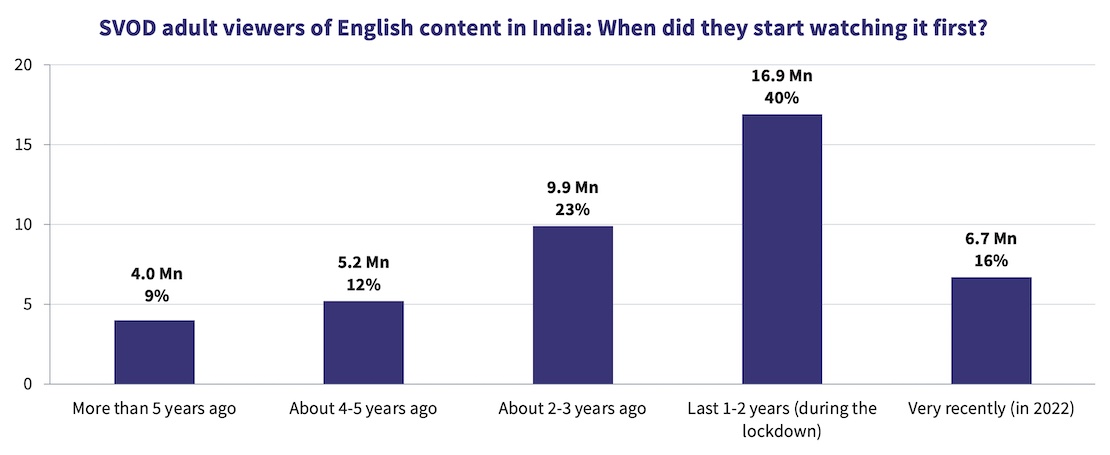

But how has the audience base for English SVOD audience grown in India in recent years? To understand this, English content audience were asked when they first started watching English content on OTT platforms. They were asked to pick one out of the five options given to them. The results can be seen in the chart below:

The English content SVOD audience base in urban (15+ yrs.) India has increased from 19.1 Mn pre-pandemic, to 42.7 Mn now, i.e., a huge growth of 124% in just two years. A large part of this growth comes from a particular audience segment called “Lockdown Millenials”, who are young audiences who got initiated into initiated into English content only in the last two years, largely through social media and their friends, but are watching a wide variety of formats and genres already.

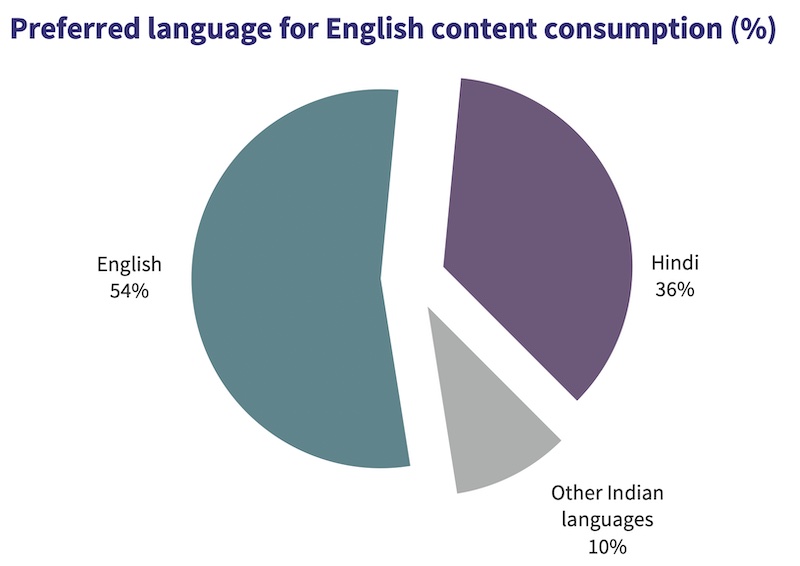

The lockdowns saw an inflow of audiences into the OTT category in general, but also increased the audience’s consumption of content outside their native languages, benefiting English content consumption in India immensely. However, a large section of the audience continues to consume English content in a language of their comfort. The preferred (audio) language, to watch English content in, can be seen in the chart below:

With 46% SVOD audience of English content preferring to watch it in an Indian language, it can be seen how content availability in Indian languages has led to a massive surge in viewership for English content in the post-pandemic, OTT era. We believe this trend will continue to be a key factor in the near future too, leading to further growth of English content consumption in India, via greater access and engagement.

The whitepaper provides more such insights and data points, and provides a reality check to stakeholders who still dismiss English content as niche.

You can download the whitepaper here.

You can read more about the whitepaper in Mint, The Financial Express and Deadline.

Hathi Ram Chaudhary: Integrity in action

A character analysis of Hathi Ram Chaudhary (Paatal Lok) elucidates why he stands out as a unique protagonist in the crowded thriller genre on Indian streaming

Now streaming, at an app near you

An analysis of the streaming rights for India’s top theatrical films released between 2022 and 2024 reveals a duopolistic landscape with significant implications for the Indian theatrical industry

Brand Lift measurement tool: Ormax Mpact

An overview of Ormax Mpact, a state-of-the-art Brand Lift Measurement tool designed to help marketers and advertisers evaluate the impact of their media campaigns, collaborations, and innovations

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy