By Our Insights Desk

In this May 2021 post, Ormax Media’s Founder-CEO Shailesh Kapoor argued that the growth story of the Indian streaming category has been quantity-led thus far, with a very long tail of unremarkable properties. He questioned if this model of growth, which relies primarily on volumes, is sustainable over time.

Since then, several other original shows and films have launched in India, and that warrants the need of an annual category report card for streaming originals in India. Being the first edition, this report covers original Hindi content launched over two years (2020 & 2021) together. We hope to add other languages to this analysis in due course.

The Parameter

Ormax Power Rating (OPR) is a score on a 0-100 scale that represents how much a show or a film is liked by its viewers. We collect OPR data for all major original shows and films for four weeks post their launch. Only viewers of the show or the film are asked to score it on our proprietary OPR scale. Hence, OPR is a reach-agnostic measure. A show may have five times the viewership of another, but have much lower OPR, because the latter may have found more love in its small and focused target group.

OPR is also the central measure used in our content testing products (see this explainer). Higher OPR leads to higher conversion of initial (first weekend) sampling to total (lifetime) sampling, as well as higher completion rates. OPR data forms the heart of our work in theatrical and streaming categories. Properties with 60+ OPR tend to sustain well, while those with 70+ have long runs, and tend to be supremely successful. Properties below an OPR of 50 tend to struggle, while those below 40 can die within days of launch.

The Volumes

Across all major streaming platforms in India, 233 original shows and 117 original films launched in the Hindi language over these two years. That’s an average of 2.3 shows and 1.1 films per week. These numbers do not include properties whose original language was not Hindi, e.g., Jai Bhim, but went on to do well in Hindi. The films number is understandably boosted because a large part of this period was affected by the pandemic, which meant several theatrical films were release direct-to-OTT instead.

The Performance

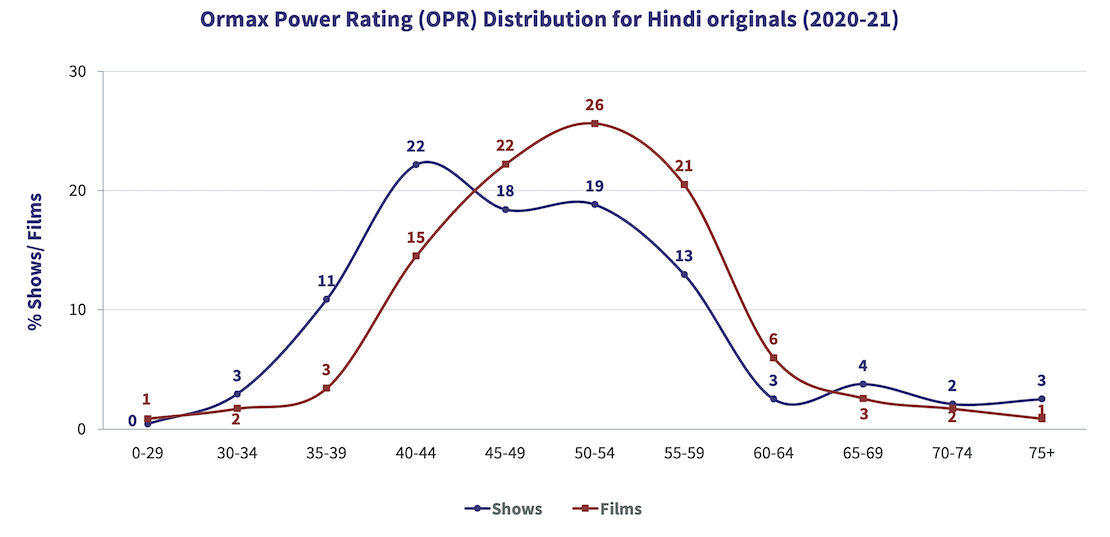

The chart below captures the OPR distribution of these 233 shows (blue) and 117 films (red), i.e., % shows/ films that fell in each OPR bracket.

Only 26 shows and 13 films manage to cross the respectable threshold of 60. These numbers amount to 11% each of the total shows and films launched. In other words, just a little more than 1 in 10 shows or films got audience appreciation to some sizeable degree. In theatrical terms, one would tend to associate the word “Hit” with these properties.

A large chunk of films (46%) score in the middling range (the 50s). This proportion is poorer for shows, with only 32% in the 50s, and a larger set (55%) facing rejection, i.e., a score in the 40s or even lower.

There are no striking differences between 2020 and 2021 at all. Both years are nearly identical on all counts: number of launches and the proportion of ‘hit’ properties. This is unusual, because one would expect leading players in a new category to build progressive understanding of its target audience with time, and deliver content better suited to their taste.

The ‘Hits’ (Shows)

Disney+ Hotstar and Amazon Prime Video dominate the list of 26 shows with 60+ OPR, with nine entries each. The Family Man S2, Mirzapur S2 and Paatal Lok are the top 3 on the Amazon Prime Video list, while Special Ops, Special Ops 1.5 and Criminal Justice S2 take the top 3 positions on the Disney+ Hotstar list. Sony LIV comes in next with three (Scam 1992, Avrodh and Gullak S2). Netflix (Kota Factory S2), ZEE5 (Abhay S2) and Voot (Asur) have a show each in this list, while the remaining two are from YouTube-based platforms (Dhindora by BB Ki Vines and Aspirants by TVF).

12 out of the 26 are franchise shows, highlighting the growing trend of franchise dependence in India. The franchises The Legend Of Hanuman, Aarya, Hostages, Breathe and Hostel Daze feature on the list, besides the ones mentioned above.

14 of the 26 shows belong to the ‘crime, action & thriller’ genre group. TVF brings in the much-needed genre variety, with five shows in the list, all in the youthful, comedic and slice-of-life space.

The ‘Hits’ (Films)

With five films in the list, Amazon Prime Video leads the pack of 13 films with 60+ OPR: Shershaah, Sardar Udham, Chhalaang, Shakuntala Devi & Sherni. Netflix and Zee5 do better on films than shows, with three 60+ OPR films each over the two years. Mimi, Ludo and Serious Men for Netflix, and Kaagaz, State Of Siege:Temple Attack and Silence for Zee5. Disney+ Hotstar takes the remaining two positions, with Dil Bechara and Khuda Haafiz.

At least eight of these 13 films were originally created for a theatrical release, but took the OTT route because theatres were closed during the lockdown. With theatrical business getting back to normal in early 2022, we could see the success rate of original films on streaming struggling to match the already-low 11% benchmark set over 2020-21.

Looking Ahead

The streaming boom in India is around for everyone to see. While we can expect the quantity of original shows to stay at the same level in 2022 too, one hopes that more than just about 1 in 10 of them manage to build on the strength of strong appreciation from the audience. The films front will see less activity in 2022, with platforms more likely to rely on streaming windows of theatrical releases, than too many direct-to-OTT films.

OWomaniya! 2024: Quantifying gender diversity in Indian entertainment

The fourth edition of the OWomaniya! report by Ormax Media & Film Companion Studios, presented by Amazon Prime, reveals glaring statistics on gender disparity in the Indian entertainment industry

Content Testing: Frequently Asked Questions - Part 3

In the third and final edition of this explainer series, we continue to answer frequently-asked questions about our Content Testing work for theatrical, streaming and television domains

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy