The pandemic gave a major boost to the then-fledgling OTT (streaming) category in India, which saw a significant surge in the lockdown months on an entire spectrum of metrics, ranging from users to paid subscribers to watch hours. The lockdowns have been lifted, and life has moved on since then, but the momentum that the OTT category gathered in 2020 continues to sustain.

Between April 2020 and March 2023, i.e., a period of three years, 565 Hindi language originals (series, direct-to-OTT films, documentaries, etc.) were launched on major OTT platforms in India. This comes to a staggering average of 15.7 properties per month, or just under four properties per week. International content, originals in other Indian languages, and OTT releases of theatrical films also compete for the same time and attention, adding to the options available to a pay OTT consumer in India today. And if you add social media videos, such as those on Instagram Reels, to the mix, and the sea of content begins to look infinite in its expanse.

Navigating through this crowded landscape can make it challenging for the marketing of an original piece of content to stand out. We used data from Ormax Stream Track, which was coincidentally launched in April 2020, to understand this better.

Ormax Stream Track (OST) is a weekly track that surveys viewers of OTT original content in India to ascertain their response to upcoming and recently-launched shows. One of the key parameters reported in OST is called Buzz, defined as a score on a 0-100 scale, that measures % audience who recalled the show or film unaided, when asked to recall upcoming or recently-launched OTT shows or films. Buzz is a strong indicator of the talk value of the property, i.e., the degree and effectiveness of conversations around it, among regular OTT audiences. Buzz typically peaks in the week of launch, or in the week just after launch, though some properties can peak two weeks after launch too, because of strong consumer pull (word-of-mouth).

Of the 565 properties mentioned above, only 126 achieved a peak Buzz of 10 or more. This amounts to 22% properties. That’s not a very low number; it’s simply the 80:20 rule at play. But if one takes the peak Buzz threshold a notch higher to 15, only 69 properties manage to make the cut, i.e., only 12% of the 565 Hindi originals launched over three years.

A Buzz of 15 should be nothing to gloat about. It simply means that about 1 out of 7 of your target audience could recall your show or film’s name unaided. Yet, almost 9 out of 10 properties failed to achieve this modest threshold.

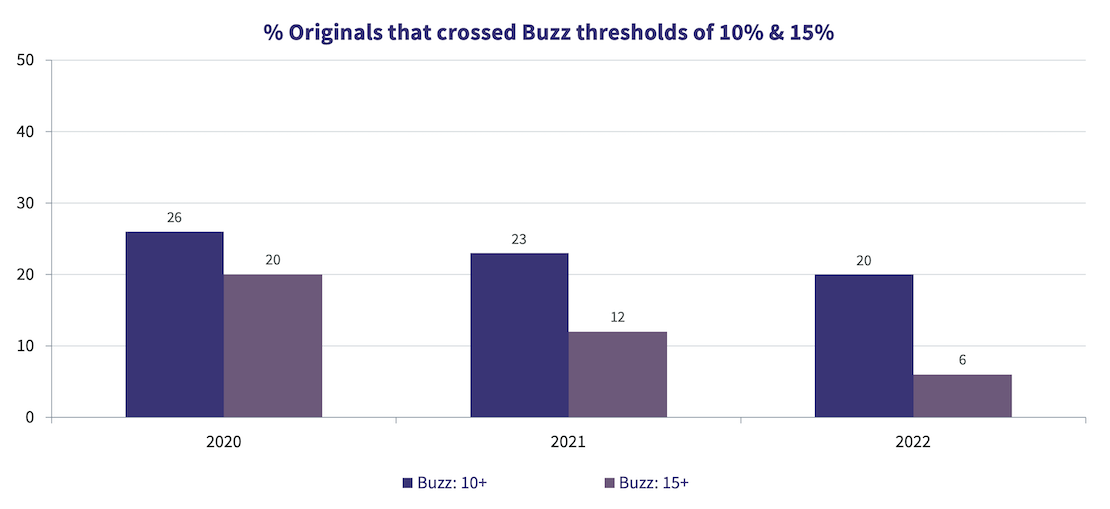

Not just that, it’s become progressively tougher to achieve the thresholds (both 10% and 15%) in the post-pandemic world. As seen in the chart below, only 6% properties launched in 2022 achieved managed to touch a peak Buzz of 15.

Viewer attention is no longer undivided like the pandemic months. They are back to their routine, movie theatres have re-opened, life has moved on. But the content is being churned out at the same rate as the pandemic years. Of the 565 Hindi properties, 196 were launched in Apr 2020-Mar 2021, 188 in Apr 2021-Mar 2022, and the remaining 181 in Apr 2022-Mar 2023. Even as content production refuses to slow down, the accumulation of content over time adds to the clutter at the consumer’s disposal, making it even tougher for new properties to stand out.

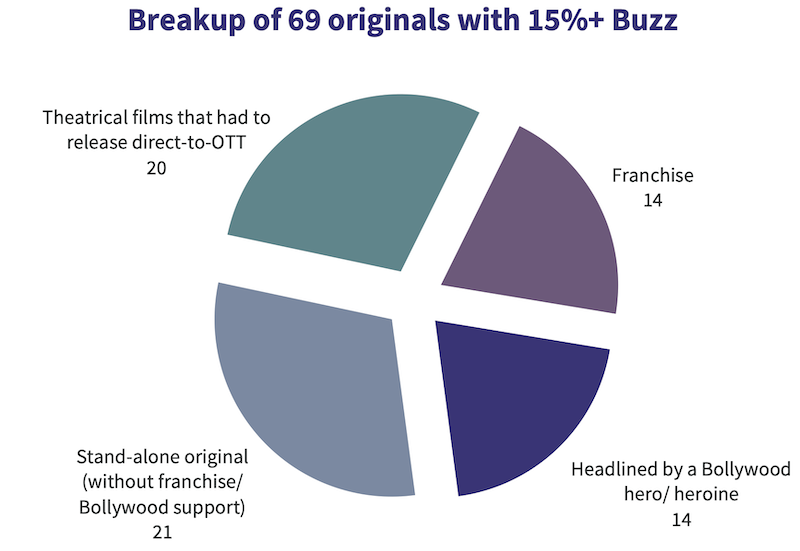

The breakup of the 69 properties, seen in the chart below, that managed to achieve the threshold Buzz of 15, tells its own story.

20 of the 69 originals that met the threshold were not meant to be originals. They were films made for the big screen, but forced to launch as OTT ‘originals’, because theatres remained shut for a prolonged period in 2020 & 2021. This list is headlined by Dil Bechara, Gulabo Sitabo, Laxmii, Radhe: Your Most Wanted Bhai, and Shershaah.

Of the balance, 14 are franchise properties, i.e., a new season of an already-established property, such as Mirzapur S2, The Family Man S2, Aashram S2, Panchayat S2 and Kota Factory S2. 14 other properties are headlined by Bollywood stars who are (or have been) mainstream heroes or heroines, such as Shahid Kapoor (Farzi), Abhishek Bachchan (Breathe: Into The Shadows), Sushmita Sen (Aarya), Ajay Devgn (Rudra) and Deepika Padukone (Gehraiyaan).

Only 21 originals remain, where a Buzz of 15 has been achieved by a property originally designed for OTT, and without the support of Bollywood stars or franchise equity. Leading this list are Paatal Lok, Panchayat (S1), Scam 1992: The Harshad Mehta Story, and Betaal. It’s not a coincidence that all four are 2020 properties.

The clutter will continue to pile up, and new properties will find it increasingly tougher to stand out in the crowd. But the success of the following properties, which managed to achieve the threshold Buzz of 15 in the last six months (since Oct 2022) is reassuring. It tells us that while routine campaigns and content may struggle to stand out, the smartly-conceived or marketed ones will still break through.

Platforms need to break the clutter with marketing that stands out in this crowd of incessant launches. Else, they have to hope that the content works so well that it creates its own marketing momentum. But every show is not Scam 1992 or The Family Man. Smart allocation of marketing budgets to the right shows or films, with smart creative strategies backing these budgets, is the need of the hour.

Ormax Trac20: Ad & sponsorship effectiveness research for IPL 2026

Our new tool Ormax Trac20 combines weekly ad tracking and multi-stage brand lift diagnostics to help IPL 2026 sponsors & advertisers measure impact and optimise in-season performance

OWomaniya! 2025: Quantifying gender diversity in Indian entertainment

The fifth edition of the OWomaniya! report by Ormax Media & Film Companion Studios, presented by Prime Video, reveals glaring statistics on gender disparity in the Indian entertainment industry

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy