While the growth and success of theatrical content from the four South Indian language markets has been celebrated and commented upon, there has been only scant conversation about the evolution of OTT originals, especially on pay (SVOD) platforms, in the South. Although many language-based OTT platforms catering to Tamil, Telugu, Malayalam and Kannada audiences have come up in the last few years, the journey of OTT originals, especially web-series, in the Southern languages is still in a nascent stage.

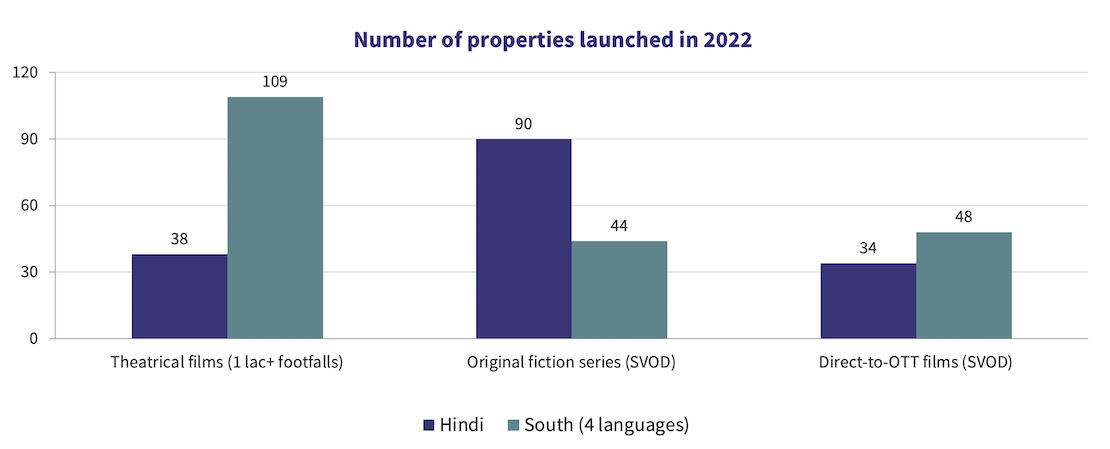

To understand the relative maturity stages of the Hindi OTT originals and those in the South languages, the first evident point of comparison is the number of OTT originals (SVOD) released in 2022. As can be seen in the chart below, there were about 44 original SVOD series (not counting documentaries & reality shows) in the four South languages put together (more than 90% of them being Tamil or Telugu web-series) in 2022. More than double the number of series were released in the Hindi language in the same year.

The numbers look more comparable if one looks at direct-to-OTT films, where the four South languages collectively surpass Hindi. Interestingly, the number of web-series and direct-to-OTT films in the South languages is very similar (44 vs. 48), while it is highly web-series skewed in Hindi (90 vs. 34). This is the first sign that the South markets, both the creators and the audience, are still getting used to the long format, that requires significantly higher time investment from the audience.

If we look at theatrical films, the numbers tell a very different story. Only 38 Hindi (original language) films grossed ₹5 Crore (₹50 Million) or more at the India box office, while the number is 109 for the four South languages, with Telugu alone being higher than Hindi at 39 films. And this, despite the significantly lower ticket prices in South India.

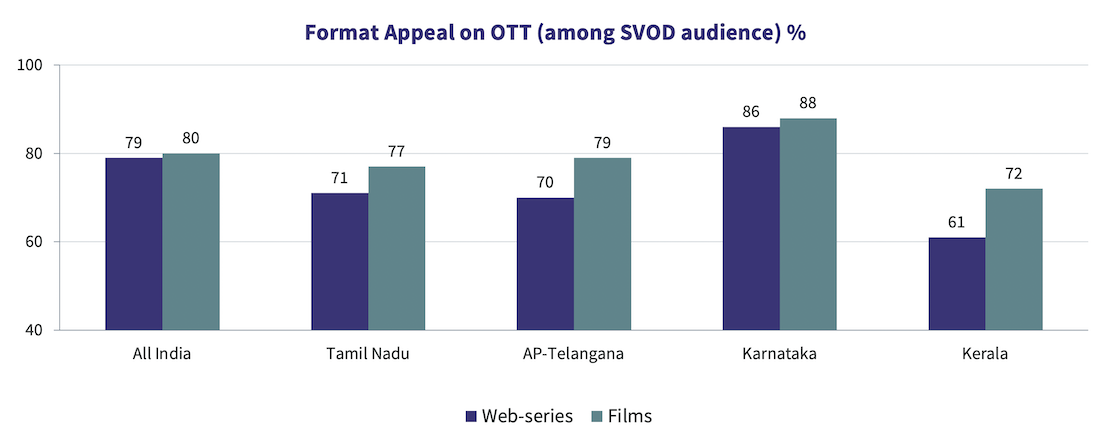

Data points in the chart above clearly suggest that South markets on OTT show a preference towards the film format, compared to web-series. Evidently, the OTT originals landscape in the Southern languages is at a much earlier phase in its evolution compared to its Hindi counterpart. As a natural outcome, consumer expectations, in terms of formats, genres, themes, etc., are still in their formative stages in the South. For comparison, Hindi web-series were at a similar number way back in 2018-19 (pre-pandemic), highlighting that the Southern OTT originals industry is at least 3-4 years behind Hindi on the product life cycle.

This provides OTT platforms that are creating original content for these markets with a unique opportunity, i.e., to create defining content that can shape consumer and category codes for the near and mid-term future, much like the success of shows like Sacred Games and Mirzapur, did for the Hindi OTT landscape in 2018. However, given that these markets are shaped by their theatrical (film) content, and have low inherent disposition towards web-series as a format, the category codes from the Hindi markets cannot be (or at least should not be) borrowed or replicated.

The chart below, sourced from The Ormax OTT Audience Profiling (SVOD) Report: 2022, showcases the Appeal (intention to watch) content in different formats on OTT at an all-India level, vis-a-vis the four Southern states.

While the two formats are at par at an all-India level, web-series lag behind films on Format Appeal in three of the four South states. In Karnataka, this is not the case, but that's only because of Bengaluru, which is a cosmopolitan market accepting of International and Hindi content, and hence, at a more mature stage in its evolution as an OTT originals market.

The difference of about 10 points in Appeal for the web-series format vis-a-vis films in Tamil, Telugu & Malayalam markets may not seem sizeable at first glance. But not all those who “intend” to watch a web-series in their mother tongue in South have started doing so already. There have been very few series, like Suzhal (Amazon Prime Video), that have managed to break out and expand the market, which is still characterized by low exposure to the series format. In fact, our viewership estimates suggest that International series like Money Heist and Stranger Things have got more traction in these markets than many local language series.

Consumption of films (especially those released theatrically first) on OTT, hence, continues to be the dominant form of content consumption for SVOD audiences in South India. In a market where theatrical content is driven by star loyalty and deeply-entrenched habit, creating compelling content that will change consumer attitudes and behavior towards the new world called “web-series”, remains a challenging task.

Ormax Trac20: Ad & sponsorship effectiveness research for IPL 2026

Our new tool Ormax Trac20 combines weekly ad tracking and multi-stage brand lift diagnostics to help IPL 2026 sponsors & advertisers measure impact and optimise in-season performance

OWomaniya! 2025: Quantifying gender diversity in Indian entertainment

The fifth edition of the OWomaniya! report by Ormax Media & Film Companion Studios, presented by Prime Video, reveals glaring statistics on gender disparity in the Indian entertainment industry

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy