By Vikas Johri

According to our report Sizing The Cinema: 2024, India has 157.4 Million or 15.7 Crore theatre-goers i.e., those who watched at least one film in a theatre in 2023. This not only marks a 29% increase compared to the previous year (12.2 Crore), but also surpasses the pre-pandemic level (14.6 Crore) by 8%.

But is cinema-going a well-formed habit among Indian theatre-goers?

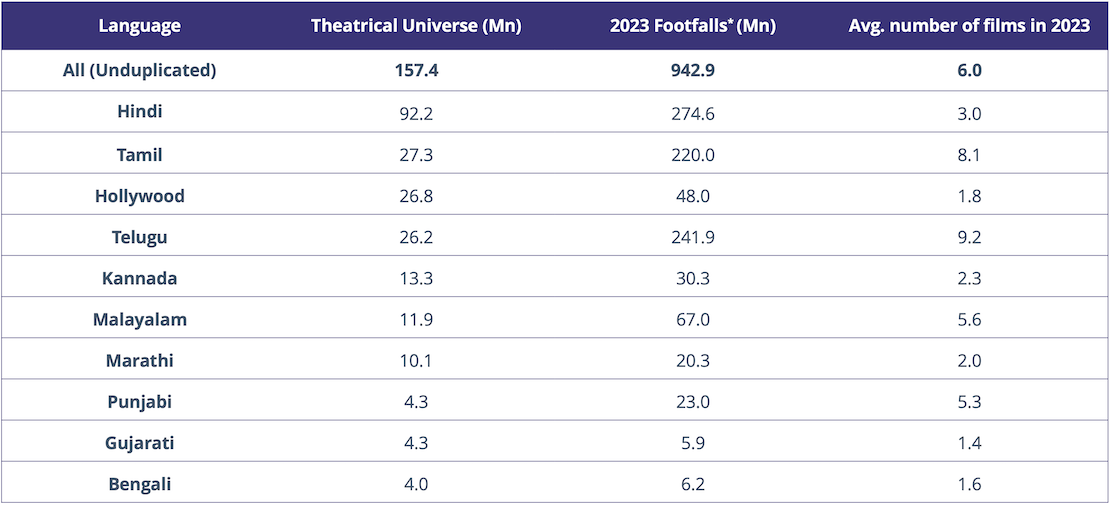

To answer this question, let's start with a key chart from the Sizing The Cinema report, where we see the average number of films an Indian theatre-goer watches, across different languages.

The footfalls in the chart above are based on The Ormax Box Office Report: 2023, which you can download here.

The 15.7 Crore audience contributed to the 94.3 Crore footfalls at the domestic box office in 2023, which comes to an average of 6.0 films watched by a typical theatre-goer in India, across all languages put together. Where there are significant variations in this number by languages (as seen in the table above), does this average number of six suggest that cinema-going is a habit?

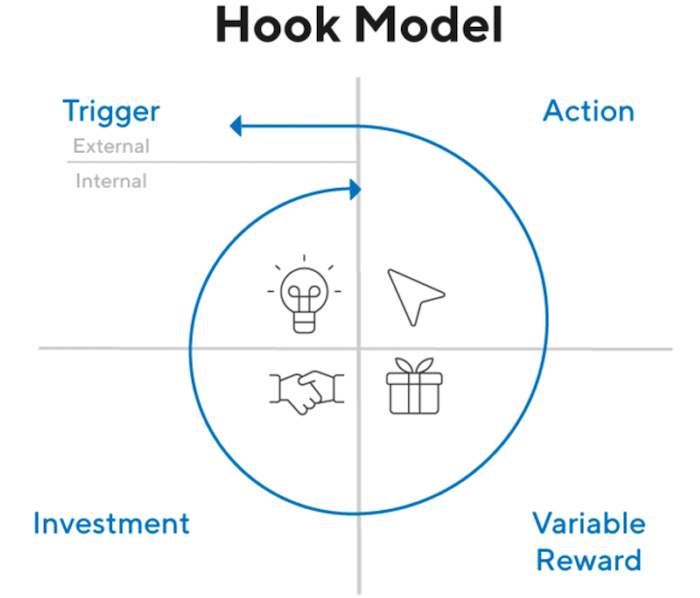

To answer that question, one needs to begin by understanding what constitutes a habit. In his book titled Hooked: How to build Habit-forming Products”, author Nir Eyal presents a framework called the 4-step Hook Model, about what constitutes a habit, and how habits are formed:

Understanding the Hook model

1. Trigger

The author describes a trigger as “the actuator of behaviour – the spark plug in the engine.” There are two forms of triggers: external and internal. Habit-forming products use external triggers such as an email or a website link to alert users. When users start to automatically cue their next behaviour, without the need of an external trigger, the new habit becomes part of their routine. In other words: as soon as users no longer need an external alert, a habit – powered internally – has been formed.

2. Action

A trigger is ineffective if it isn’t followed by an action. The author explains that “to initiate action, doing must be easier than thinking”. This focus on making actions as easy as possible is one of the key reasons why companies are moving towards ‘single purpose’ apps and are constantly looking to reduce the number of steps that users have to go through.

3. Reward

In the book, the author explains that when users are (pleasantly) surprised by a new reward, it is likely to have an impact on their usage of the product or service. Three different types of rewards are further explained in the book: the “Tribe” (centred around making an individual feel accepted, attractive, important, and included), the “Hunt” (incentivizing users to constantly chase a feeling) and the “Self” (helps an individual in personal gratification). Habit-forming products tend to use one or more of these reward types in order to keep users excited and engaged.

4. Investment

The final element of the Hook model is “investment”. This is about getting users to invest, to put effort into a product. A psychological phenomenon known as the “escalation of commitment” results in people being driven to keep on investing into a product or service.

An evaluation of cinema-going as an activity, in the context of Indian cinema, will help us examine whether it is a habit among Indian cinema-goers, especially for young audiences (i.e., aged 12-21 yrs.), where the habit of theatrical-viewing is still taking shape.

Evaluation of cinema-going as a possible habit, on the Hook model

1. More external triggers than internal triggers

For Indian cinema-goers, these triggers could include movie trailers, advertisements, posters, word-of-mouth recommendations, or social events. More importantly, it is observed that major releases (event films), festivals, and holidays serve as stronger external triggers, indicating that cinema-going could be more seasonal or event-based. While boredom, need for entertainment, and social experience are internal triggers that drive the theatrical experience, the presence of robust competition for each of these needs by other social entertainment options (i.e., live events, experiential activities, restaurants, etc.), makes cinema-going significantly dependent on external triggers.

2. Social nature of the activity in India, adding layers of friction to the action

The second stage of the Hook model is Action, which is a behaviour in performed in response to the trigger. In this case, the action is act of going to the theatres. The low frequency of theatre visits (especially for Hindi audience, where the average number of films watched in 2023 is just 3.0) suggests that the behaviour of cinema-going is not regular or habitual. Instead, it appears more likely to be an occasional activity linked to specific movies, events, or personal interests.

Additionally, given the social nature of the activity, watching a film in the theatre demands more effort, including multiple steps like coordinating with social groups, identifying showtimes, finding transportation, and incurring a significant expense. It's turns out to be a costly and cumbersome activity, compared to free or low-cost entertainment options like television or OTT viewing.

3. Highly unpredictable nature of the reward

The biggest hindrance to cinema-going emerging as a definitive habit in India, is the sizeable variance in the quality of the movies being created. While only about 15-20% of the movies created in a year manage to garner positive audience appreciation, a significant portion of the films fail to capture the audience’s imagination. Therefore, uncertainty about the quality of films, and the absence of a strong string of films as a given, prevents greater involvement in the activity.

4. Investment in stars and film personalities

Cinema investment could include buying subscriptions, joining loyalty programs, or recommending films to friends. However, these are limited, and most audience investment in India, has historically been in film stars. Audiences often invest in the star, believing that their fandom contributes to the star's success.

This connection is especially strong in southern India, where fan clubs thrive, creating a sense of belonging. This is evident in the sharp difference in the average number of films watched by audiences in the southern states compared to Hindi (Telugu: 9.2, Tamil: 8.1, Malayalam: 5.6, compared to Hindi: 3.0). This higher investment in the local stars results in higher frequency of theatrical visits emerging as a strong differentiator between Bollywood and the southern film industries. This analysis from November 2023 looks at the difference in stardom in Tamil and Telugu industries vis-à-vis Bollywood, presenting a possible hypothesis for the difference in the audience’s investment levels.

Conclusion

Considering all these components, the habit loop framework suggests that cinema-going in India, with an average of just six films per year, might not be a habit in the conventional sense. The relatively low frequency indicates that the triggers are less consistent, the action (going to the cinema) is cumbersome, and the rewards might not be strong enough to drive regular behaviour. The investment in stars and their stardom is the only definitive part of the model that has a clear positive outcome. However, with ageing stars, across industries, this phenomenon could also soon come under threat. This implies that cinema-going in India tends to be more event-based, tied to specific releases or occasions, rather than being a habitual activity.

The full version of Sizing The Cinema: 2024 report is available by paid subscription. The report profiles India's theatre-going audience by gender, age, pop strata, markets, film territories, and languages. You can email us at [email protected] for details related to the report and its subscription.

The India Box Office Report: October 2025

Driven by Kantara - A Legend: Chapter-1, October 2025 has emerged as the highest-grossing box office month of the year at the India box office, with gross collections of ₹1,669 Cr

Venn It Happens: SVOD & Theatrical audience intersection

The second edition of our new feature Venn It Happens illustrates the intersection between SVOD and Theatrical audiences in India, using data from Ormax Media's industry reports

Ormax Cinematix's FBO: Accuracy update (October 2025)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major October 2025 releases vis-à-vis their actual box-office openings

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy