By Our Insights Desk

The Indian media landscape is a complex one, and the intersection of various audience types can often be confusing, even for those who have spent many decades in the business. We are often asked questions in this direction, such as: What percentage of pay audiences on streaming also visit movie theatre? What is the overlap between TV and digital? Do audiences watch sports only on TV or OTT, or do they often switch between the two modes of consumption? Is there an overlap of audiences on OTT between the various South Indian languages?

Over the years, Ormax Media has been publishing industry reports and data to address such questions. We recently started a new series called Venn It Happens, in which we will periodically publish Venn diagram illustrations on how various audience types in the Indian media market intersect. You can access the first edition of the series, on the intersection between the OTT and Linear TV audience universes in India, here.

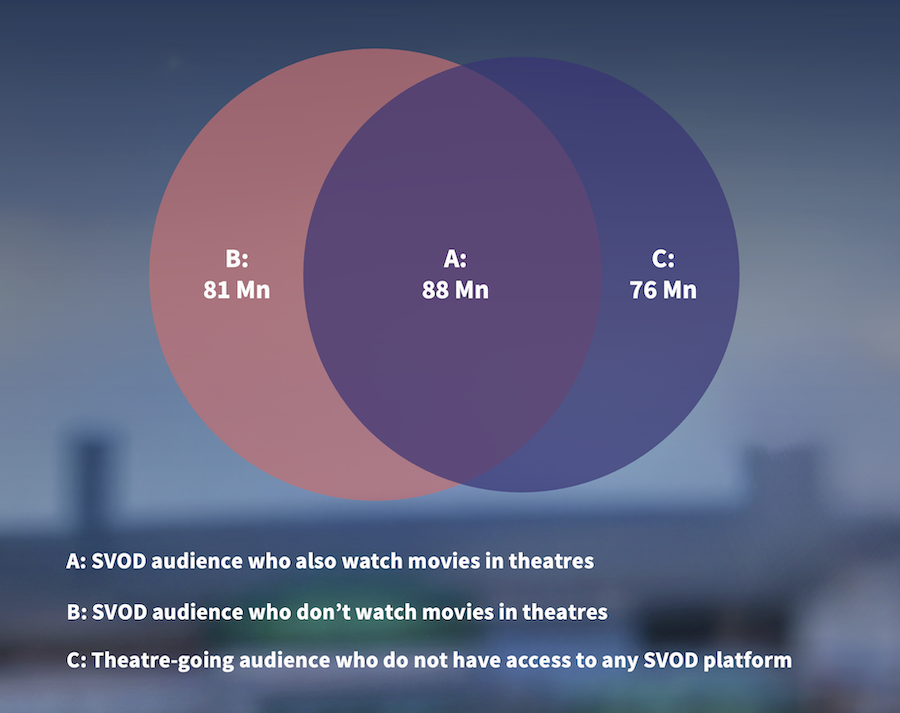

The section edition of Venn It Happens looks at the intersection between the SVOD and Theatrical audience in India.

Data from this infographic has been sourced from The Ormax OTT Audience Report: 2025, our annual industry report to size and profile the OTT audience base in India, and Sizing The Cinema: 2024, our report to size the theatrical audience in India. Since Sizing The Cinema report is typically released every alternate year, reasonable assumptions have been made to bring the theatrical data points to mid-2025 levels, using theatrical footfalls movement since the last report.

A+B is the 169 million SVOD audience base in India, i.e., those who watched a digital video that needs a paid subscription, at least once in the last one month. A+C is the theatrical audience base in India, i.e., those who watched at least one movie in a theatre (any language) in the last three months, which adds up to 164 million audience.

Some inferences that can be drawn from the chart above:

1. All three segments are broadly similar in size, in the 75-90 million bracket. While there is a significant overlap of 88 million, the SVOD-only and theatrical-only segments are individually sizeable too.

2. While the SVOD-only segment (B) is more intuitive to understand, as these are often seen as audiences who may have stopped going to theatres because of SVOD services, it's very likely that a large proportion of them (upto 70-75% in our estimation) were not going to theatres even before SVOD services came to India, and have transitioned from satellite television to SVOD to watch new movies. Of course, a section of them (about 25-30%) will not be interested in movies as a category, and would use SVOD services primarily for sports and series content.

3. The theatrical-only segment (C) comes primarily from single-screen audiences, especially in South India, where the Average Ticket Prices (ATP) is low, and hence, a wider audience is available for theatrical sector, compared to the big cities in the Hindi theatrical market.

If you have queries on the methodology, or want to subscribe to the underlying reports, please email us at [email protected], and we will connect with you soon.

Ormax Cinematix's FBO: Accuracy update (December 2025)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major December 2025 releases vis-à-vis their actual box-office openings

The India Box Office Report: November 2025

November 2025 was an underwhelming month at the India Box Office, recording only ₹587 Cr in gross collections. However, the year stays on course to become the highest-grossing year of all time

Ormax Cinematix's FBO: Accuracy update (November 2025)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major November 2025 releases vis-à-vis their actual box-office openings

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy