By Mitesh Thakkar, Gautam Jain

Before COVID-19 put the brakes on it, Indian box office was on a high in 2019, with gross domestic collections (across languages) crossing the ₹ 10,000 mark for the first time (see Ormax Box Office Report 2019). Hindi, Tamil, Telugu and other language industries adapted fairly well to the COVID crisis, taking the direct-to-streaming route, as well as reworking their budgets and production plans based on practical constraints. However, for one film industry, COVID was not the only concern: The Marathi film industry was already facing a barrage of challenges, including in 2019.

The Marathi film industry has been consistently creating award-winning cinema. Films like Fandry, Court and Kaasav have earned the industry a reputation of being content-centric and meaningful. Additionally, astounding box office business of films like Sairat, Natsamrat and Lai Bhaari made Marathi cinema come across as a lucrative business proposition, not too many years ago. However, Marathi cinema’s box office story is nowhere as rosy as these perceptions.

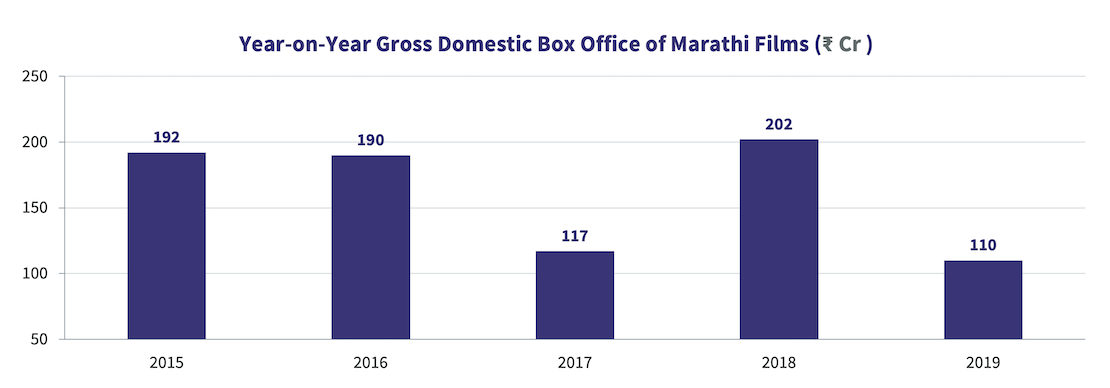

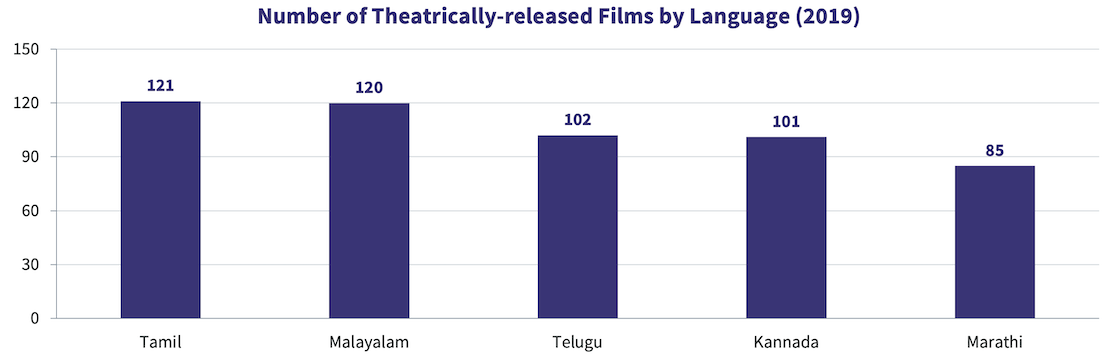

In the five pre-pandemic years (2015-2019), gross box office of Marathi films managed to cross the ₹ 200 Crore mark only once, in 2018. For a huge state like Maharashtra, these numbers can only be termed paltry. If we look at a much-smaller state in Kerala, the Malayalam film industry, also known for its high-on-content cinema, did almost six times the business of Marathi film industry in 2019. That puts in perspective how low the operating levels of the Marathi box office are.

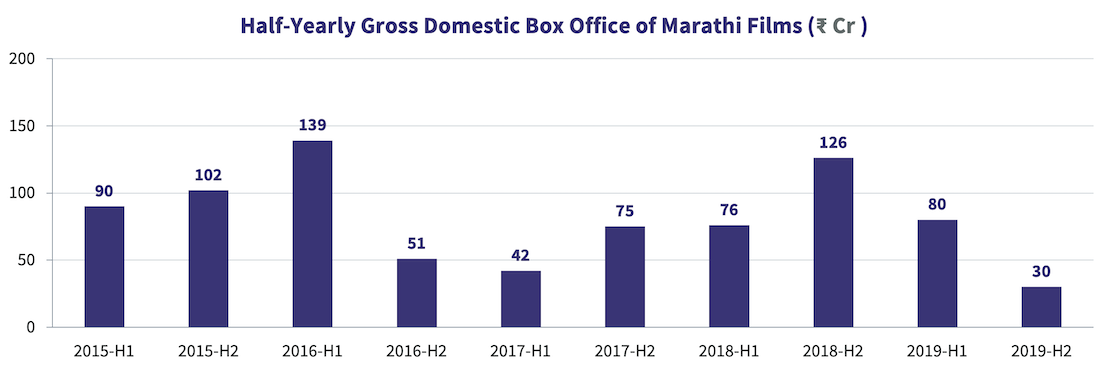

The problem is not just in the absolute numbers but also in the trendline. Unlike other languages, there is no growth trend visible at all, with the box office showing an inconsistent pattern year-on-year. If we look at the same numbers at a half-yearly level, the inconsistency gets magnified further.

There are four inherent, somewhat-connected flaws in the business model of Marathi cinema that limit its box office potential. Let's understand them in some detail:

1. Over-dependence on big films

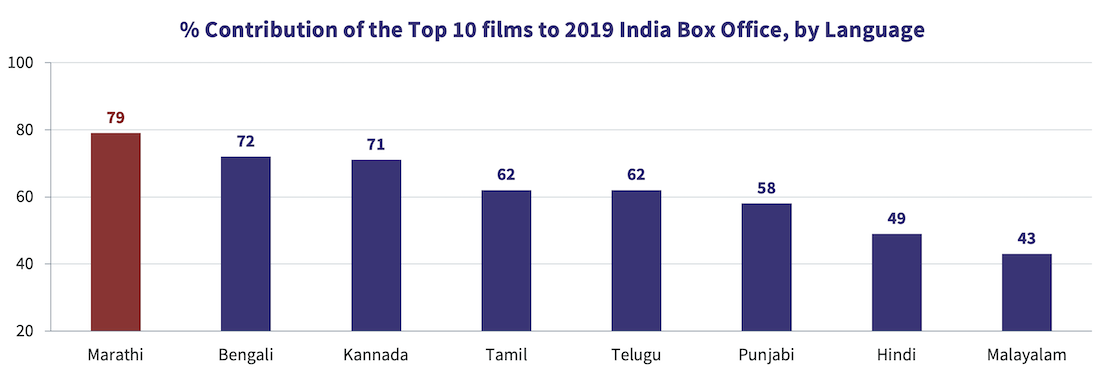

In 2019, 79% of the total Marathi box office came from the Top 10 films, a proportion that’s significantly higher than other languages.

The chart above highlights how Marathi cinema lacks a long tail, and hence, in years like 2017 and 2019, when some of the top titles fail to deliver, the numbers can simply nosedive.

2. Limited influence of star power at the box office

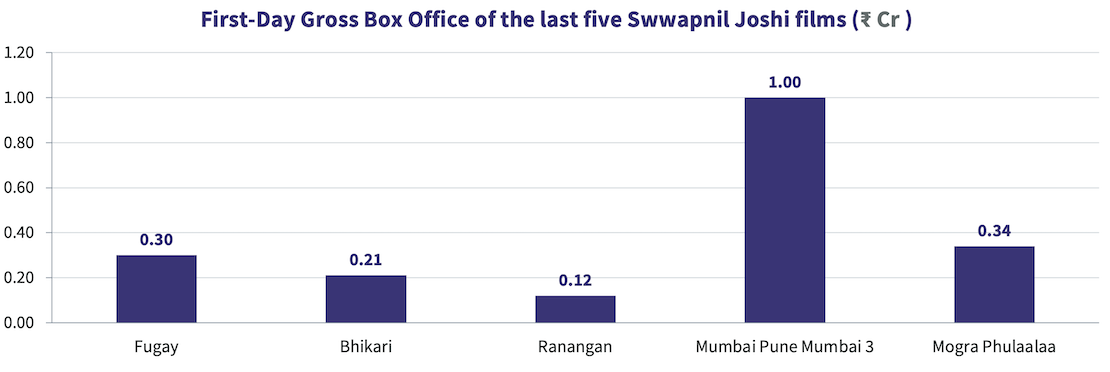

Marathi cinema lacks the firepower that stars bring to the box office business in most other Indian languages. Many Marathi stars have had parallel careers in films, television, theatre, and more recently, streaming. Unlike stars in the South, or even in the Hindi film industry, Marathi stars do not carry the aura or the exclusivity of a star who must be watched on the big screen. As a result, even films featuring the most popular Marathi stars have registered inconsistent box office openings, such as the example of Swwapnil Joshi films in the chart below. Because a Marathi film producer cannot be assured of a minimum box office opening no matter how popular the star is, making Marathi films a riskier proposition than other languages, despite the budgets being lower.

Another factor that limits the influence of Marathi stars is the lack of youth appeal. The average age of the top 10 male stars on Ormax Stars India Loves (Marathi) is 48 years, while that for female stars is 39 years, which is a notch higher than their equivalents in other languages.

Youth is a key audience to secure a strong box office opening, and the absence of popular young stars means that films must rely on relevance of their subjects to attract the youth. But only a few films like Boyz and Takatak have managed to connect with the youth and open well.

3. Inexperienced producers

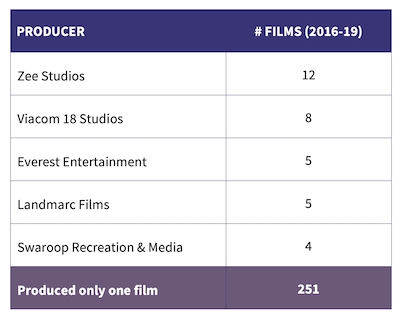

If we look at the last four years, there are only a few studios that have produced and released Marathi films consistently, with Zee Studios and Viacom 18 Studios being the most prominent ones. Because the investment in a Marathi film is significantly lesser compared to other languages, success of a handful of Marathi films lured many first-time producers into trying their luck in Marathi cinema. A total of 263 unique producers have released a Marathi film in the last four years, of which 251 have only produced one film!

A first-time producer lacks the experience and capability to mount and release a film like a studio, who has the advantage of a slate of films, media tie-ups, marketing expertise, and established relationships with leading exhibitors.

A related issue faced by many first-time producers is the time gap between green-lighting the project to the actual release of the film. Many films remain unreleased for a long duration because of issues like budget constraints, lack of marketing expertise, or unwillingness on the part of exhibitors to provide adequate showcasing. When such a film is eventually released, it often bears a jaded look, resulting in instant rejection by the audience.

4. Sub-par marketing & release strategy

Due to the lack of star power and the inexperience of the producer, marketing of most Marathi films lacks planning and rigour. In the last four years, numerous films have released just with a launch campaign of just one week. And then, there are many cases where the gap between the trailer launch and the release is very long, even six months at times.

Marathi media, especially television, is part of networks like Zee and Viacom 18, which also have their studio arms producing Marathi films. Hence, it becomes easier for studios to get media space for their own films, while it can be an uphill task for a first-time or independent producer.

The root issue here is that there are way too many releases. 85 Marathi films released theatrically in 2019, which is just a notch lower than the four South languages, which have a a far more sizeable audience base to address (see our Sizing The Cinema report for more).

In an industry where even a solo release finds it difficult to sustain at the box office, 2019 saw 11 weeks where three or more Marathi films released on the same day. This leaves these films with virtually no chance at the box office at all.

With the pandemic effect on the box office going away with time, and box office across languages beginning to bounce back, the Marathi film industry has its task cut out. It must address some core structural challenges, such as those covered in this analysis, for a more consistent performance at the box office. Otherwise, the industry runs the risk of becoming irrelevant over the next few years, with only the odd release or two standing out.

Ormax Cinematix's FBO: Accuracy update (February 2026)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major February 2026 releases vis-à-vis their actual box-office openings

OWomaniya! 2025: Quantifying gender diversity in Indian entertainment

The fifth edition of the OWomaniya! report by Ormax Media & Film Companion Studios, presented by Prime Video, reveals glaring statistics on gender disparity in the Indian entertainment industry

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy