By Our Insights Desk

Launched in 2010, Ormax Cinematix (OCX) is our proprietary campaign tracking and forecasting tool for theatrical film releases in nine major languages, tracking over 750 films every year. OCX surveys 2,000 theatre-going audiences every week, capturing their engagement with upcoming releases through three key parameters: Buzz, Reach, and Appeal. This data, when combined with market factors such as release scale, ticket price, and holiday release, is used to forecast the first-day box office (domestic) of the tracked films. This parameter, known as FBO serves as the cornerstone of OCX, relied upon by numerous subscribers across languages. Last year, we published this explainer, addressing 12 frequently-asked questions about FBO.

Box office forecasting is complex, involving an interplay of over 20 variables across both demand and supply sides. The comparison between FBO and actual film openings has sparked considerable discussion within the Indian film industry. At times, perceptions of a film’s ‘accuracy’ emerge more from hearsay than from actual data, as OCX reports are still widely pirated in the industry despite our efforts to curb this practice.

In light of this, we are launching a monthly blog that will compare the forecast (FBO) with the actual openings of major films released each month. The blog will be published in the first week of each month, covering releases from the prior month (e.g., this post covers October 2024 releases). In the monthly blogs, we will compare the final FBO (reported on release day) to the actual opening performance of each film. Actual box office data can vary by source, so Ormax generates its own estimates using a mix of reliable industry sources. These estimates will serve as the source for actual first-day box office numbers in this blog too. For questions about OCX or the box office figures in this blog, you can reach us at [email protected]

Please use this link to download a summary of FBO vs. Actual comparison for all major October 2024 releases in India. The two major Diwali releases on November 1 have also been included in this blog, given the high interest in them.

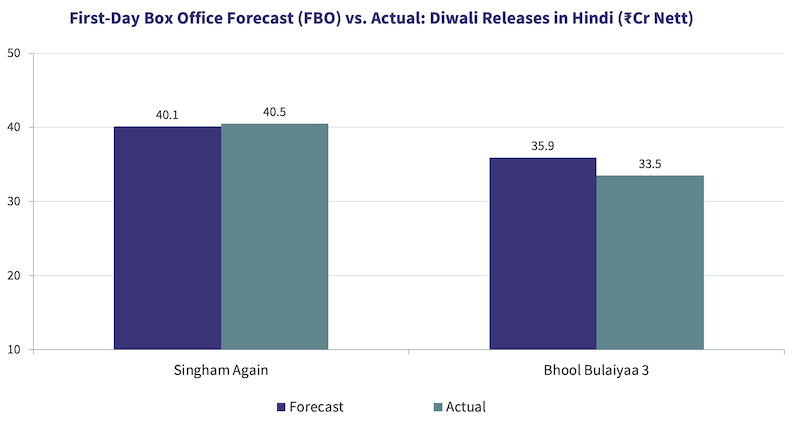

Diwali Releases in Hindi

As discussed in this analysis a week prior to the release of the two films, both were tracking at similar levels, and the difference in their box office performance primarily reflects variations on the supply side, i.e., release scale and multiplex showcasing.

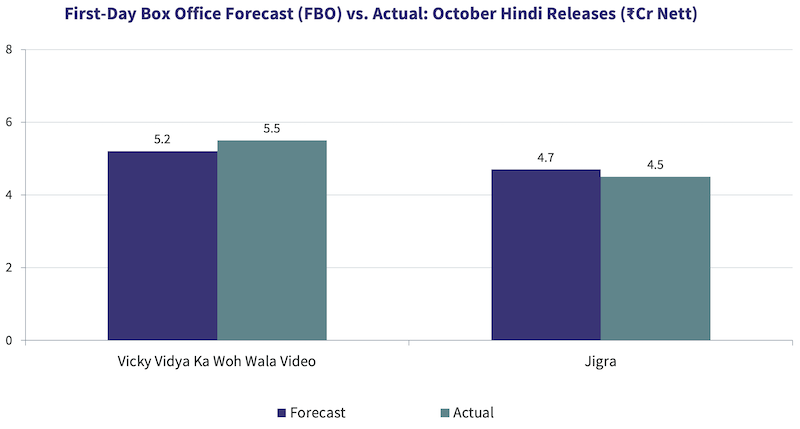

October Hindi Releases

In October, there were only two major Hindi film releases, and OCX accurately forecasted their opening within 5% of the actual figures.

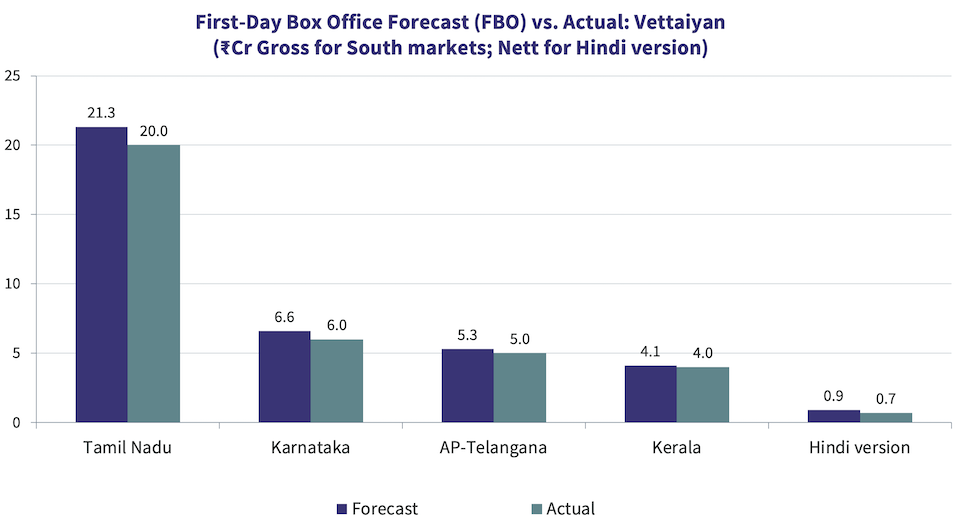

Vettaiyan

The Tamil film Vettaiyan released across multiple regions in original and/or dubbed versions, and we could accurately forecast its performance in all markets.

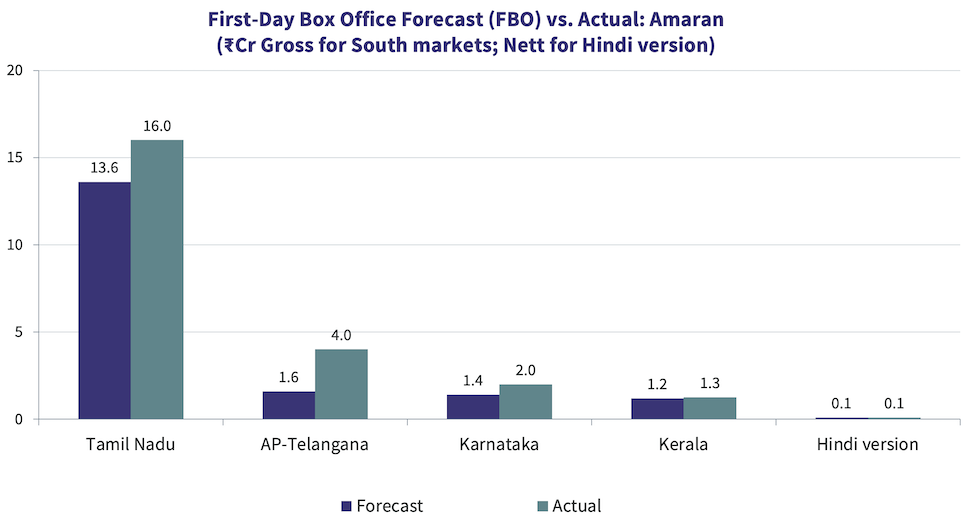

Amaran

The Amaran campaign gained significant momentum leading up to the film’s release, especially after the trailer launch a week prior. This momentum was further fueled by a very positive audience response to the content, which boosted the film’s prospects on the Diwali holiday. Unlike in the Hindi markets, where the Diwali day (Laxmi Puja) is not favorable to the box office, the performance of several South language films released on October 31 indicates a holiday-driven upside. The FBO Model captures this effect based on historical data, and learnings from this year’s Diwali releases will further strengthen the model.

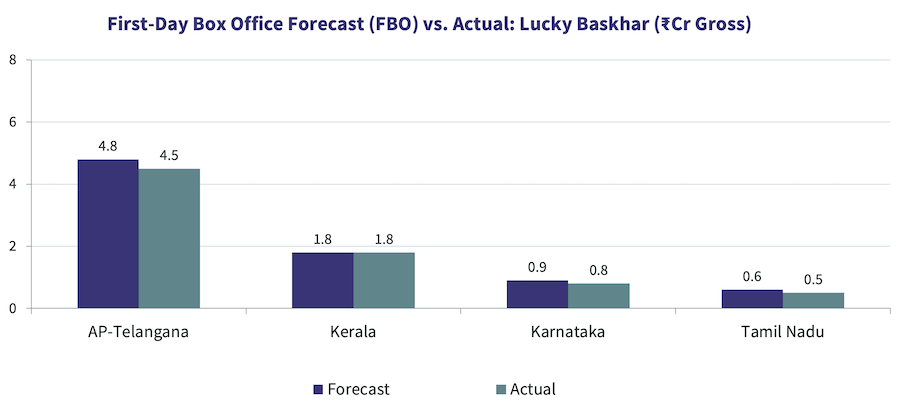

Lucky Baskhar

The Telugu film Lucky Baskhar was released across Southern markets, with a stronger release in its primary market (AP-Telangana) and the home market of its lead star Dulquer Salmaan (Kerala). OCX accurately forecasted the film’s performance, despite the complexities associated with the holiday.

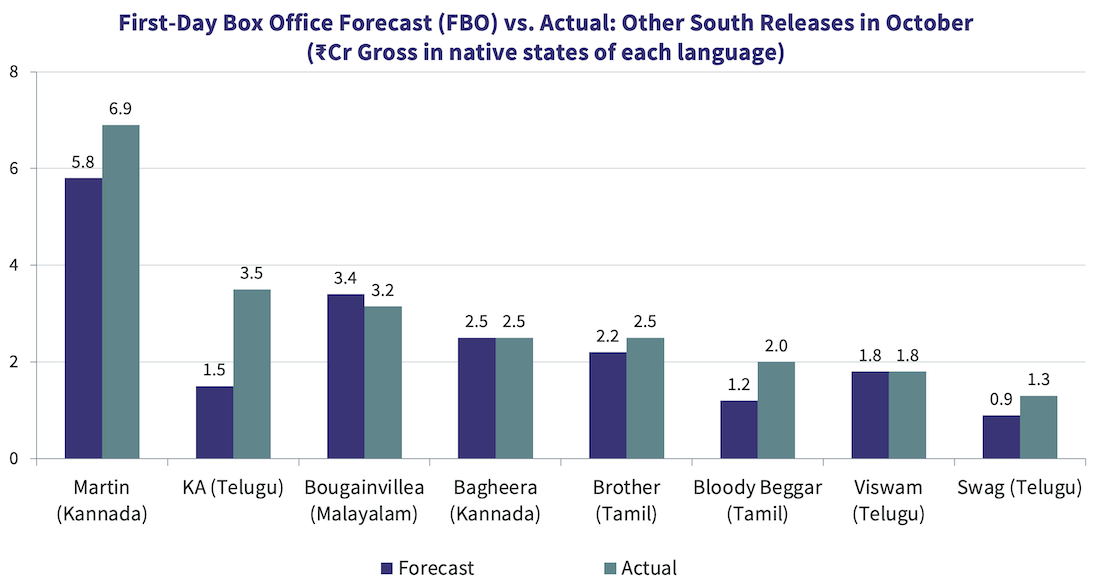

Other South Indian Language Films

Two of the films released on the Diwali day, KA and Bloody Beggar, outperformed the FBO model’s forecast. KA particularly benefited from a very positive audience response, leading to growth in footfalls over the course of the day.

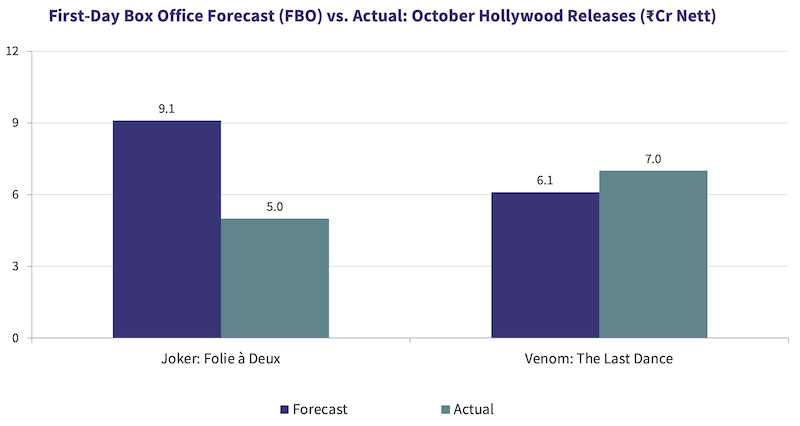

Hollywood Films

Among all films across languages, the widest deviation between FBO and the actual box-office opening occurred with Joker: Folie à Deux. Several factors contributed to this deviation. The film was released on a mid-week holiday (Wednesday, October 2) compared to a similar holiday falling on a Friday - a scenario for which the FBO model lacks sufficient data points. While this was the primary factor behind the forecast inaccuracy, poor content further widened the gap, as negative reviews and audience word-of-mouth led to fewer-than-expected walk-ins during the latter half of the day. Overall, audience behaviour towards Hollywood films in India has been unstable post-pandemic. We are working diligently to develop the model to account for holiday and word-of-mouth impact that Joker: Folie à Deux saw.

Note: There were no major releases in the other three languages in which OCX tracks films, i.e., Marathi, Punjabi, and Bengali, in October 2024.

The Ormax Box Office Report: 2025

Powered by Hindi cinema’s strong comeback, 2025 became the biggest year ever at the Indian box office, with gross collections of ₹13,395 Cr, even as footfalls stayed flat

Introducing Ormax Media Affluence (OMA)

OMA is a new audience classification system designed specifically to measure affluence level of audiences in context of the media & entertainment sector in India

Ormax Cinematix's FBO: Accuracy update (December 2025)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major December 2025 releases vis-à-vis their actual box-office openings

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy