The latest edition of The Ormax OTT Audience Report, released last month, confirms that the post-pandemic honeymoon period for the paid streaming (SVOD) category is now over.

The numbers speak for themselves. India’s OTT universe, defined as those who watched at least one digital video in the past month, grew by a healthy 13.8%, from 481 million in 2023 to 547 million, in 2024. You can read the headlines of the report here.

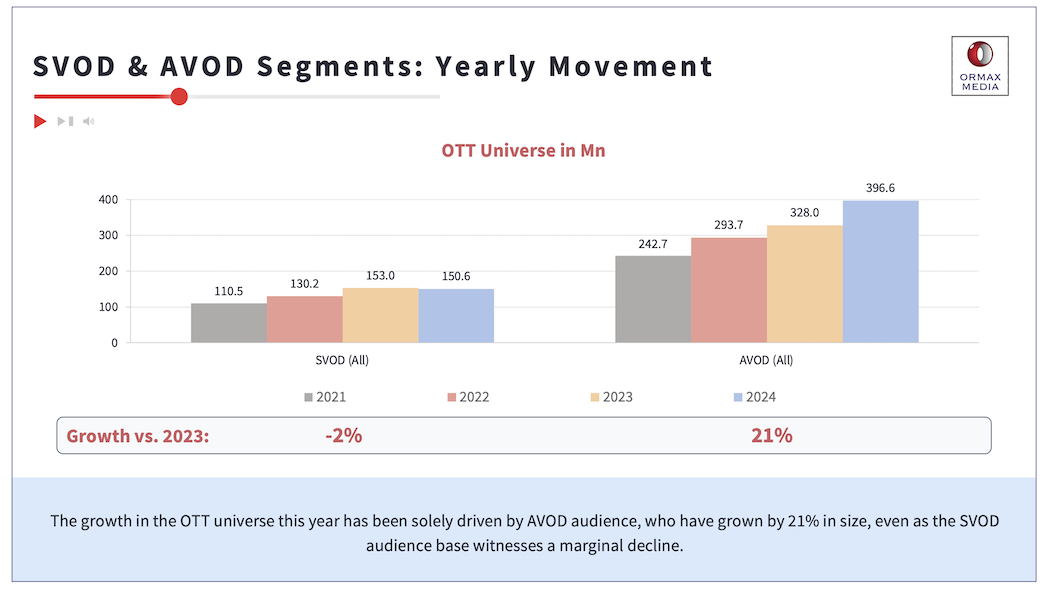

Interestingly though, this entire growth has come from the AVOD segment, i.e, those who only watch videos that are free to stream (and ad-supported). The SVOD universe, i.e., those who have access to videos that are behind a paywall, has not grown at all, in fact de-growing by 2%, as we can see in the snapshot from the report below.

Consequently, the share of the AVOD audience in India’s digital universe has increased from 68% to 72%, while the SVOD audience share has declined from 32% to 28%. The direction is evident: Audiences are less keen to pay for OTT subscriptions than before. The total number of direct paid subscriptions have also fallen from 101.8 million to 99.6 million.

This wasn’t the narrative of the Indian streaming business till about a year ago. When JioCinema decided to remove the paywall in front of the IPL in 2023, it was seen as a bold and aggressive move. Since then, all marquee cricket has been available for free streaming, relying on the advertising revenue potential of its massive reach. While we do not have an exact data point, it is reasonable to assume that at least 10-15% (or possibly more) of paid subscriptions were taken only to stream live cricket. But that doesn’t fully explain the stagnancy in paid subscriptions between July-September 2023 (well after IPL 2023) and June-July 2024, the period of data collection of the two reports.

An equally important trend to underline is the stagnancy in consumption of OTT originals (series and direct-to-OTT films). According to our viewership estimates tracking, an average SVOD audience in India watched 12.3 originals across the year in 2023 (at least one episode for series; at least 30 mins. for films). That’s a little more than one a month, which is not a big number to begin with. The equivalent number for originals launched in the first half of 2024 is 5.1, which converts to an annual prorated projection of 10.2. Which means that there’s a 17% drop in the number of originals being watched by a typical SVOD audience member in India from 2023 to 2024.

Part of the problem could be the dwindling supply itself. 2023 saw the release of 383 Indian streaming originals across languages (all major platforms except YouTube). The equivalent number is 206 for Jan-Aug 2024, which means an annual prorated projection of 309, which is 19% lower than 2023. But this supply drop is largely from the long-tail. If we look at the major national platforms (Netflix, Amazon Prime Video, Disney+ Hotstar, JioCinema, Sony LIV, and Zee5, Amazon miniTV), the drop in the number of originals is lower, at 11%.

Whether one argues from the demand side or the supply side, the message is clear: The interest of the Indian SVOD audience in original streaming content is declining. Other forms of content, such as theatrical films on streaming, sports, YouTube, and social media videos, are likely to benefit, capturing a larger share of the audience’s time. But originals have been the strategic centerpiece for SVOD platforms, and the falling interest in them does not augur well for their plans for the coming year.

One must then question the quality of content on offer, and its ability to keep the audiences invested. In 2023, only 34 Hindi language originals scored 60 or more on Ormax Power Rating, a proprietary measure we deploy in our contest testing and post-launch evaluation tools (read more here). In other words, 34 Hindi originals got a positive endorsement from at least 60% of audience who watched them. The equivalent number for this year so far (Jan-Jul launches) is just 14, which means a prorated annual number of 24, i.e., a staggering drop of 29%.

In a meeting earlier this year with a senior industry leader, I casually used a common industry term to describe SVOD originals - “premium content”. The person quipped: “But is the content really ‘premium’?” That question has interested me for weeks now. Does something become ‘premium’ (a word that means ‘something of higher quality or value than usual’ in our context) just by the virtue of being behind a paywall?

The answer is self-evident, as is the conclusion. Platforms need to strive harder to create more compelling content, if they expect Indian audience, brought up on low-cost television for decades, to pay a subscription fee, over and above the data cost they are anyway incurring. “Compelling” is a subjective word, in a huge and diverse country like ours. But it’s for the platforms to identify their target audience, and understand what compelling content means to them. As it turns out, data from their past shows, many of which have middling audience endorsement, may not provide the answers.

Top 50 streaming originals in India: The 2025 story

Our year-end report looks at the Top 50 most-watched originals on streaming platforms in India in 2025

Product launch: Ormax StreamView

Our new weekly tracker is designed to answer a simple, high-stakes question for the Indian media and advertising ecosystem: “What is India watching on OTT?”

Introducing Ormax Media Affluence (OMA)

OMA is a new audience classification system designed specifically to measure affluence level of audiences in context of the media & entertainment sector in India

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy