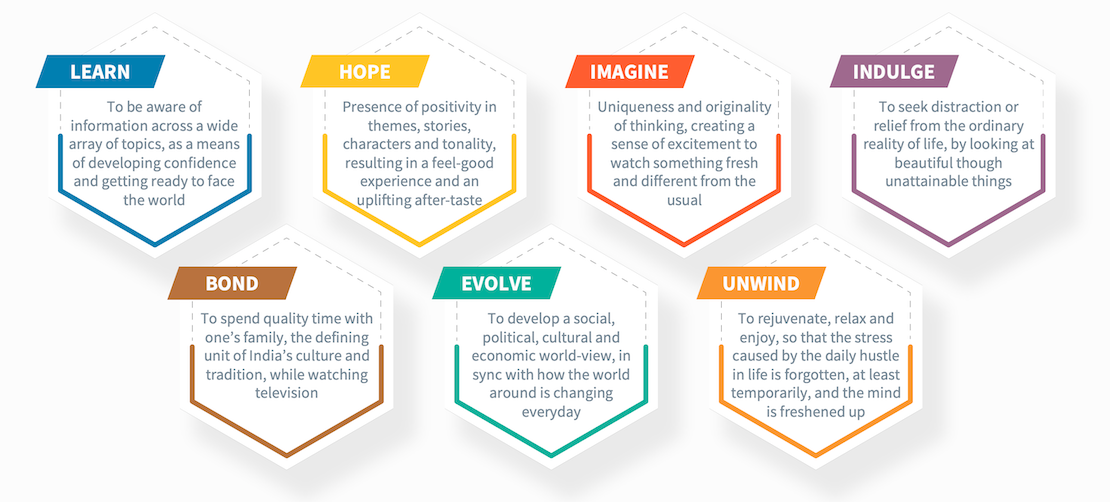

In this article last week, our Insights Desk introduced Ormax Televate, a new strategic tool that’s designed to help TV channels develop a robust viewership growth strategy. The article also introduced the seven needs satisfied by watching television in India (reproduced below for easy reference).

Ormax Televate uses regression-based modeling to determine the weights of the seven needs for each television genre. In this analysis, the performance data of various channels in the genre on the seven needs is the independent variable, and a single-number, NPS-like brand score (called Ormax Televate Score) is the dependent variable. The relative weights of the seven needs explain how important is the fulfillment of that need towards building positive equity for a channel brand, in that genre.

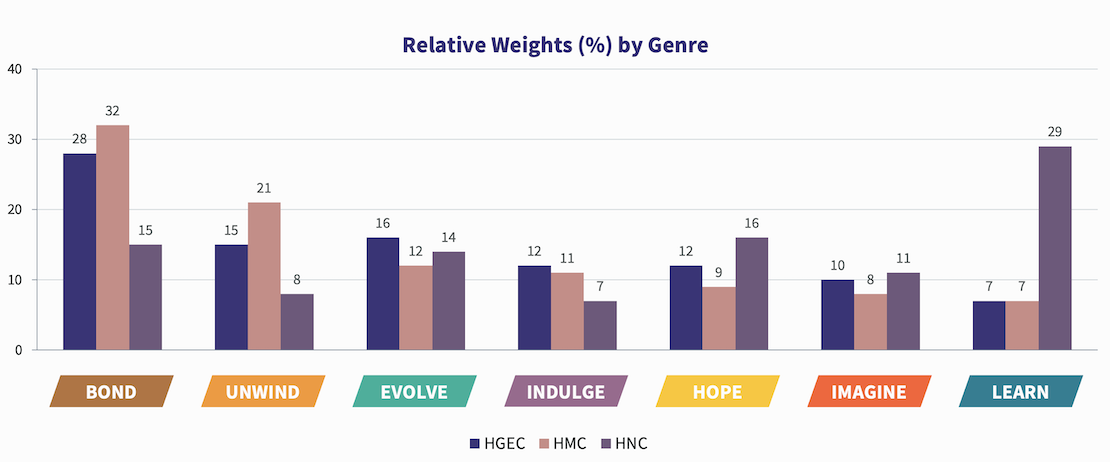

With that being the context, the chart below looks at how these seven needs stack up in terms of their relative importance in three main Hindi language genres on Indian television: Hindi GECs (HGEC), Hindi Movie Channels (HMC) & Hindi News Channels (HNC).

Bond is the dominant need for HGEC and HMC genres, controlling 28% and 32% weightage respectively. HGEC genre has a more layered second line of needs, with Evolve and Unwind leading the second lot. The no. 2 need emerges more decisively for the HMC genre, with Unwind at 21%.

But GEC content and movies on television are not the only things families in Hindi-speaking markets are bonding over. Bond features at no. 3 for the HNC genre, just a point behind the no. 2 need for the genre, Hope.

Often, the need to ‘Bond’ with the family while watching television is confused with watching family-oriented content, such as KBC or Anupama or Hum Saath-Saath Hain. While family-oriented content is a natural fit when a family of 4-6 people wants to bond over a TV viewing session, the idea of bonding over television is not content-driven per se, in the Indian context. A good parallel to explain this is going to the movies with friends or family. Diehard movie fans struggle to comprehend this, but for most movie-goers in India, a visit to a movie theatre is not so much about the content itself but about the cumulative experience of the outing, which often includes a meal, among other things.

Because the need for this outing is not a daily one, audiences can pick the films around which they want the experience to be felt. But in television, it’s at least an hour and a half of family viewing everyday, and hence, content selection is primarily a result of habit or consensus. The stakes are lower, and the idea of watching TV with the family is more important than what is actually watched. And it can also be news, if that’s the general consensus in the house at that point of time.

Our early-2021 report And The Remote Goes To… (read here) illustrates how the control over the TV remote in India is now a shared family control, than an individual one. Content must work its way around this reality. And what cannot, must make way for what can. For example, the Hindi music genre, for which the Bond need scores only 14% (Unwind leads with 22%), ranking fourth, is struggling to survive on Indian television. The rise of digital options for music consumption is as much responsible for its state, as is the genre’s inability to develop family-friendly programming ideas.

Over the last year and a half, digital video consumption, both paid and free, has risen sharply in India, and many analysts have been quick to write the obituary of the television medium. But the need to ‘Bond’ is television’s unique calling card, and it will prove all such forecasts wrong. Hypothetically, the only real threat Indian television can face is the weakening of the family institution in India over time. And that’s not happening anytime soon!

Venn It Happens: OTT & Linear TV audience intersection

The first edition of our new feature Venn It Happens illustrates the intersection between OTT and Linear TV audiences in India, using data from The Ormax OTT Audience Report: 2025

Not just nostalgia: Why legacy characters are dominating HGECs

Despite not featuring in the show since 2017, Daya (Taarak Mehta Ka Ooltah Chashmah) continues to enjoy immense popularity among Hindi GEC audiences. Her enduring success highlights a category trend

Ormax Mpact case study: Bandhan Mutual Fund on India Today TV

This case study, based on the integration executed by Bandhan Mutual Fund on English news channel India Today, showcases our Brand Lift measurement tool Ormax Mpact

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy