By Amit Bhatia, Akansha Tyagi

Urban romcoms refer to the strand of Hindi theatrical romantic comedies rooted in contemporary city life, with modern relationship dynamics, premium lifestyle cues, and humour-led storytelling. Recent examples that fit this mould include Rocky Aur Rani Kii Prem Kahaani, Tu Jhoothi Main Makkaar, Teri Baaton Mein Aisa Uljha Jiya, Bad Newz, Sunny Sanskari Ki Tulsi Kumari, Bhool Chuk Maaf, and Tu Meri Main Tera Main Tera Tu Meri.

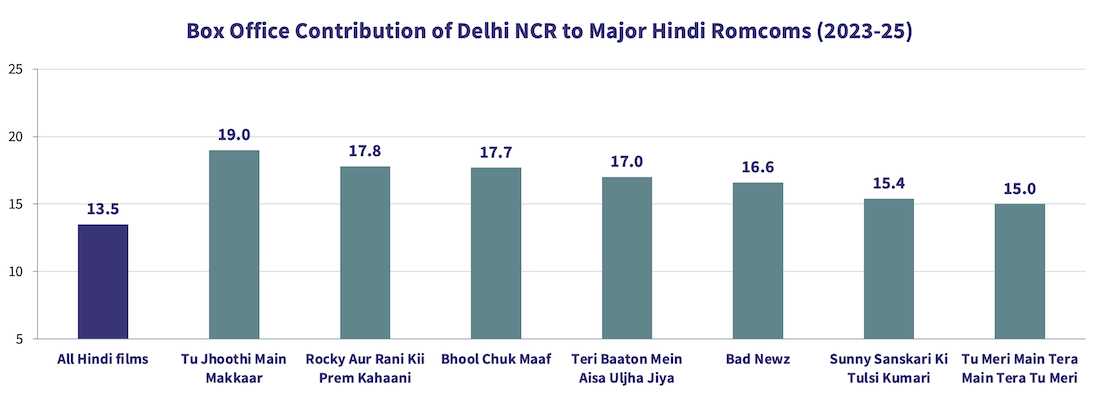

Across this genre cluster, one pattern shows up with striking consistency: Delhi NCR tends to deliver a disproportionately higher share of box office, relative to what this market contributes to the overall Hindi domestic box office. This is not because Delhi NCR is simply a large market. The signal is relative. The market becomes bigger-than-usual for this genre, across titles and across years. The chart below summarizes this trend across the seven films mentioned above.

This is not a one-off driven by a particular star, a specific campaign, or an unusually strong holiday. That makes it less a trend and more a structural insight. In effect, Delhi NCR behaves like the home circuit for urban romcoms. What explains this consistent over-indexing?

Cultural relevance and relatability

Urban romcoms are among the most culturally-coded Hindi film genres. Their entertainment engine is tone, not spectacle. Banter, wit, teasing, social awkwardness, and relationship negotiation are the primary sources of pleasure. These elements only convert when the audience instantly recognizes the world.

Delhi NCR offers unusually high cultural proximity to this genre grammar. A large share of mainstream romcoms are written within a North Indian urban milieu, either explicitly through setting or implicitly through language texture, social behaviour, and family dynamics. Even when the film is not set in Delhi, the cultural codes often feel Delhi-adjacent, making the humour land faster, and the characters feel familiar, which is perhaps why writers, including those from Mumbai, prefer to base their stories in and around Delhi NCR. As a result, urban romcoms do not ask Delhi NCR audiences to decode their world. They let them enter it instantly. That is a decisive advantage for a tone-led genre.

Brag culture, weddings, and aspirational social theatre

One of the most consistent reasons behind Delhi NCR’s romcom affinity is that urban romcoms align closely with the market’s public culture of aspiration and social display. Delhi NCR has a strong outward-facing lifestyle ecosystem where weddings, celebrations, fashion, visible consumption, and status signalling are prominent. Urban romcoms are dense with these cues: big wedding backdrops, designer styling, premium social spaces, lavish parties, and colorful celebration environments.

Importantly, these cues are delivered through a tone that is light and emotionally positive. The opulence is not framed as class commentary. It is framed as entertainment. That makes the indulgence guilt-free and widely appealing. In a market where the wedding economy and lifestyle performance are culturally central, this genre becomes disproportionately “sticky”.

Punjabi music as a genre accelerator

Modern Hindi romcoms are strongly driven by music and vibe. Over time, the commercial grammar of this genre’s music has increasingly skewed towards Punjabi and ‘North Pop’, not just in the album, but in the film’s overall cultural energy.

Delhi NCR has higher cultural closeness to Punjabi tonality, wedding beats, and celebratory pop than several other circuits, which makes this soundscape especially effective here. The songs land harder, the vibe carries longer, and the theatre experience feels more “worth it”. This improves recall and talkability, and strengthens the emotional high points that romcoms rely on.

The multiplex ecosystem: A 'structural' advantage

The other half of Delhi’s romcom advantage is not cultural, it is infrastructural. Urban romcoms are multiplex-native, high on dialogue, vibe, and premium styling, and they depend on casual social viewing rather than spectacle-led turnout. Delhi’s exhibition ecosystem supports this perfectly.

A useful anchor is that India’s multiplex era effectively began in Delhi, with PVR opening the country’s first multiplex at Vasant Vihar in 1997. Since then, multiplex exhibition has scaled dramatically, and Delhi NCR has remained at the heart of that expansion, especially across affluent pockets of South Delhi, Gurugram and NOIDA, where several multiplexes often sit within minutes of each other. This high multiplex density increases access and convenience, improves mixed-group participation, and supports sustained weekday footfalls, mechanically strengthening the genre’s repeatable over-indexing.

Conclusion

Put together, the data points to a simple but powerful conclusion: urban romcoms do not just play well in Delhi NCR, they are structurally advantaged there. Cultural familiarity lowers entry friction, aspirational social cues amplify appeal, Punjabi-inflected music boosts vibe, and a dense multiplex ecosystem converts intent into footfalls. None of these factors alone would be decisive. But together, they create a reinforcing loop. For producers and distributors, this means Delhi NCR should be treated less as a neutral market and more as a core growth engine for the genre - a circuit where urban romcoms can reliably punch above their national weight, and often determine whether a film merely opens well or truly legs out.

Ormax Cinematix's FBO: Accuracy update (February 2026)

This edition of our monthly blog summarises Ormax Cinematix's box office forecasts (FBO) for all major February 2026 releases vis-à-vis their actual box-office openings

OWomaniya! 2025: Quantifying gender diversity in Indian entertainment

The fifth edition of the OWomaniya! report by Ormax Media & Film Companion Studios, presented by Prime Video, reveals glaring statistics on gender disparity in the Indian entertainment industry

Subscribe to stay updated with our latest insights

We use cookies to improve your experience on this site. To find out more, read our Privacy Policy